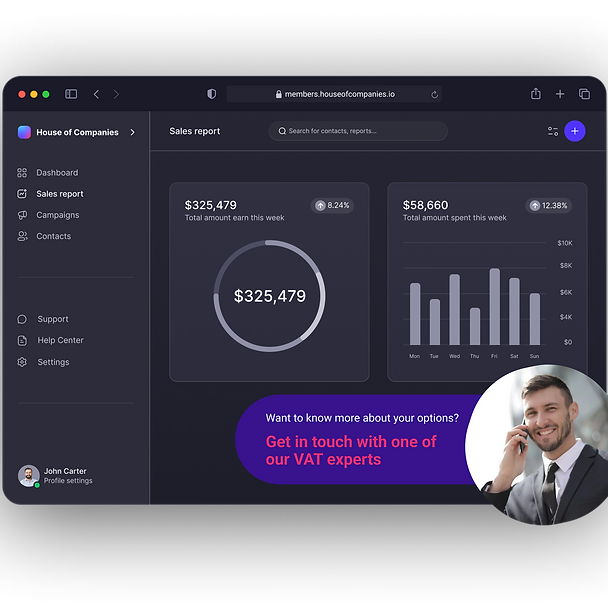

Access Our Self-Governance Portal

Kickstart your Smart Company registration by logging into our Self-Governance Portal. Here, you gain complete control over the registration process. Designed to simplify your interactions with local authorities, the portal enables you to manage all necessary documentation and legal requirements through an intuitive and user-friendly interface.

Choose the Right SC Structure

Identify the Smart Company structure that aligns perfectly with your business goals. With various options tailored to different industries, sizes, and business models, our expert team is ready to guide you in selecting the structure that offers optimal operational and tax advantages.

Submit Required Documents

To register your Smart Company, you'll typically need the following documents:

- Company name and articles of association

- Personal identification of company directors and shareholders

- Proof of a registered office address in Dubai

- Declaration of business activities

- Our portal allows you to upload these documents securely, and we will verify them to ensure compliance with local regulations.

Company Name Reservation

Easily check and reserve your company name through the portal to ensure its uniqueness and compliance with local legal standards. This crucial step helps prevent any conflicts or delays in the registration process.

Sign the Notarial Deed of Incorporation

Once your documentation is in order, a notary will prepare and sign the Deed of Incorporation, formally establishing your Smart Company. We coordinate with registered notaries to facilitate this process, ensuring everything is managed efficiently.

Register with the Local Chamber of Commerce

Your Smart Company must be officially registered with the local Chamber of Commerce. Our portal streamlines the submission of all required documentation, ensuring a hassle-free registration experience. After registration, your company will receive a unique registration number, confirming its legal status.

Obtain Tax Identification Numbers

To operate legally, your Smart Company must secure a tax identification number (TIN) and a Value-Added Tax (VAT) number. Our team assists you in navigating this process, ensuring timely registration with the relevant tax authorities.

Open a Corporate Bank Account

A corporate bank account is vital for your financial transactions. We can help you establish an account with a reputable local bank, enabling smooth transactions both locally and internationally.

Finalize Registration and Start Operations

After completing all necessary steps, you'll receive confirmation of your Smart Company’s registration, allowing you to officially commence operations. Our dedicated team is here to provide ongoing support post-registration, ensuring your business runs smoothly and complies with all legal requirements.

Registering a Smart Company

Smart Companies in strategic jurisdictions can yield substantial benefits based on your business objectives and operational requirements. Each location offers distinct advantages, making it crucial to select the ideal one for your expansion plans.

Dubai

Dubai is an exceptional choice for Smart Company registration, known for its vibrant business landscape and strategic position in the Middle East. Companies registered here enjoy access to a vast market, favorable tax regimes, and 100% foreign ownership in many sectors. The UAE's world-class infrastructure and connectivity facilitate smooth operations, making it perfect for businesses aiming to thrive in both regional and global markets.

United Kingdom

Despite Brexit, the UK remains a strong contender for SC registration, offering a streamlined and efficient registration process. With competitive corporate tax rates and a well-established legal framework, the UK continues to attract businesses looking to expand internationally. Its robust global trade connections and economic stability further enhance its appeal.

Singapore

Renowned as a global financial hub, Singapore is a top choice for Smart Company registration, especially for businesses eyeing the Asian market. With low corporate tax rates, exemptions for new companies, and strong intellectual property protections, Singapore creates a welcoming environment for enterprises. Its strategic location ensures easy access to vital Asian markets.

United Arab Emirates (UAE)

Beyond Dubai, the UAE is famous for its numerous free zones that offer unique advantages like 100% foreign ownership, no corporate or income tax, and superior business infrastructure. These free zones are especially beneficial for businesses seeking tax-efficient operations in a strategically located hub with extensive global connectivity.

Hong Kong

Hong Kong stands out as a premier jurisdiction for Smart Company registration, characterized by its low tax rates, free trade policies, and minimal barriers to foreign investment. Ideal for businesses targeting the Asia-Pacific region, it provides access to significant markets like China. As a global financial center, Hong Kong remains a top destination for companies looking to establish a strong presence in the region.

United States

In the U.S., states like Delaware offer an advantageous environment for Smart Company registration, thanks to their robust legal systems, investor protections, and favorable corporate tax frameworks. With access to the world's largest economy and a vast domestic market, the U.S. is a key jurisdiction for businesses aiming for international growth.

Luxembourg

Luxembourg presents excellent opportunities for Smart Company registration within Europe. It boasts flexible corporate structures, an attractive tax regime, and strong banking services. With a comprehensive network of double taxation treaties, Luxembourg is an appealing choice for businesses operating across borders, making it easier to maximize their international potential.

Choosing the right jurisdiction for your Smart Company registration is essential to achieving your business goals. Each of these locations offers unique benefits tailored to different market strategies and operational needs.

Establishing a blockchain business in Dubai offers remarkable advantages due to the region's forward-thinking regulatory environment and robust technological infrastructure. This comprehensive guide will navigate you through the essential steps to launching your innovative blockchain venture, ensuring an efficient setup while adhering to local regulations.

Understanding the Regulatory Framework

Dubai is renowned for its supportive regulatory approach to blockchain technology. Begin by immersing yourself in the local laws surrounding blockchain, cryptocurrency, and digital assets. The government has implemented clear guidelines to foster blockchain innovation while ensuring compliance with financial regulations and anti-money laundering measures.

Choose the Right Business Structure

Selecting the optimal business structure is vital for your blockchain venture. Options include private limited companies and free zone establishments, each offering distinct benefits regarding liability, taxation, and operational flexibility. This guide provides insights into selecting the structure that aligns with your business objectives and blockchain operations.

Register Your Business

Registering your blockchain business in Dubai is a crucial step. The registration process involves submitting necessary documents, including your company name, articles of association, and proof of address. This guide details the required documentation and steps to facilitate a smooth registration process.

Obtain Necessary Licenses and Permits

Depending on your blockchain business activities, you may need specific licenses or permits. This could involve licenses for operating a cryptocurrency exchange or providing financial services related to blockchain technology. Our guide outlines the types of licenses you might need and the application process.

Set Up a Corporate Bank Account

Opening a corporate bank account in Dubai is essential for managing your business finances. Dubai's financial institutions are increasingly familiar with blockchain and cryptocurrency operations, making it easier to find a suitable bank. This guide offers tips on selecting the right bank and the required documentation.

Comply with Tax Regulations

Blockchain businesses in Dubai must adhere to local tax regulations, including corporate tax and VAT. Understanding your tax obligations is crucial for compliance and optimizing your tax strategy. This guide provides information on tax rates, reporting requirements, and managing your tax responsibilities effectively.

Secure Intellectual Property

Protecting your blockchain technology and innovations through intellectual property rights is paramount. Dubai offers strong intellectual property protections, including patents and trademarks. This guide explains how to secure your intellectual property and the advantages it provides.

Develop a Compliance Strategy

Ongoing compliance with local and international regulations is essential for your blockchain business. This includes adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. Our guide outlines how to develop a compliance strategy and implement effective measures to meet regulatory standards.

Leverage Local Ecosystems and Networks

Dubai boasts a vibrant blockchain ecosystem filled with industry events, conferences, and networking opportunities. Engaging with local blockchain communities can yield valuable insights, partnerships, and support for your business. This guide highlights key resources and networks to help you integrate into the Dubai blockchain landscape.

Get Professional Support

Navigating the intricacies of establishing a blockchain business can be daunting. Collaborating with local experts, including legal advisors, accountants, and blockchain consultants, can provide the guidance necessary for a successful setup. This guide recommends professional services that can assist you throughout the process.

With the right strategy and support, your blockchain venture in Dubai can thrive in this dynamic and innovative landscape.

Alex J

Alex J Maria L

Maria L David R

David R