Manage your entity or launch a local business with the help of our free demo portal.

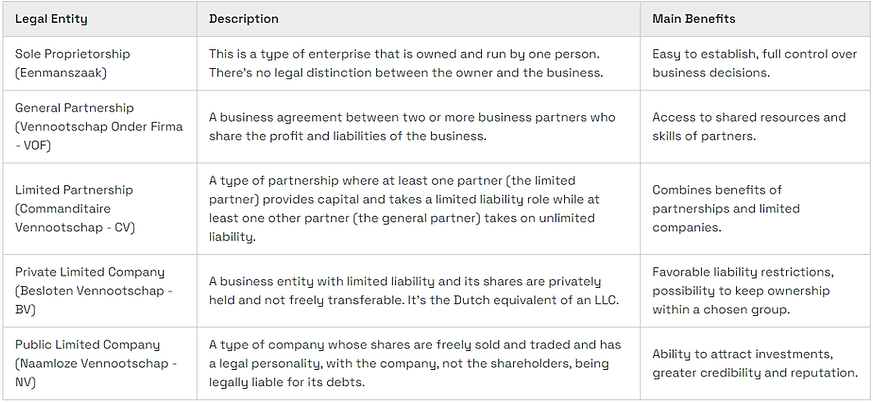

We begin by assisting you in selecting the ideal structure for your business, whether it’s a sole proprietorship, a private limited company (LLC), or a branch of an overseas company. By thoroughly assessing your company goals, we ensure that your chosen structure aligns with your operational objectives and long-term vision. This crucial step impacts your tax responsibilities, liabilities, and operational flexibility.

Once you’ve decided on a corporate structure, we guide you through the preparation and submission of all necessary paperwork to the relevant authorities in Dubai. This includes registering your business name, obtaining a trade license, and applying for your VAT number. Our team ensures that all registrations adhere to local commercial laws as well as municipal and national regulations.

Our entity management services extend beyond mere registration; we provide ongoing support to keep your business compliant with Dubai’s legal framework. This includes annual filings, tax compliance, payroll management, and tailored administrative services. Our dedicated customer support team is always available to answer your questions, keep you informed about regulatory changes, and help navigate any challenges your business may face as it grows.

We offer a comprehensive solution that allows you to focus on scaling your business. With our expertise and commitment, you can confidently enter the Dubai market, knowing that seasoned professionals are handling all aspects of your business setup and maintenance. We simplify the process of expanding abroad or launching a new venture in Dubai from start to finish, ensuring a seamless experience.

Choosing a name for your Dubai LLC (Limited Liability Company) is a vital step in crafting your business identity. Your name should encapsulate the essence of your operations while being memorable for customers. It must align with your brand image and convey the right message to your target audience. A well-thought-out name can significantly enhance recognition and trust within the marketplace.

When selecting a name, ensure it adheres to local legal requirements in Dubai. The chosen name must be unique and not overly similar to existing businesses. The Dubai Department of Economic Development (DED) maintains a registry where you can verify the availability of your desired name. If the name is already in use or too similar to another entity, it will be rejected, making an early check crucial.

Additionally, the name must include the designation "LLC" to signify its legal structure. This informs potential partners, clients, and customers that your business operates as a limited liability company. Avoid any misleading terms that could imply government affiliation or misrepresent your business's nature.

Consider the international dimension of your operations. If you plan to engage in business across multiple countries, choosing a name that is easy to pronounce and understand in various languages can help prevent confusion. It’s also wise to check for the availability of the corresponding domain name to ensure a strong online presence.

A Dubai LLC (Limited Liability Company) is an increasingly popular legal structure for businesses, offering significant flexibility regarding shareholders and capital requirements. This structure allows for private ownership, with shares allocated among shareholders who enjoy specific rights, such as voting on key business decisions and receiving dividends proportional to their ownership stake.

One of the standout advantages of establishing a Dubai LLC is the elimination of a minimum capital requirement. Since recent regulatory updates, the need for a minimum starting capital has been removed, making it easier for entrepreneurs and small businesses to set up an LLC. This accessibility encourages new ventures to launch without the strain of a substantial initial investment.

Shareholders in a Dubai LLC can be individuals or legal entities, regardless of their origin. The company must have at least one shareholder, and its shares are not publicly traded. This model of private ownership fosters greater control over the business, as shares are typically held by a select group of investors or family members, enhancing the potential for cohesive decision-making and strategic planning.

In a Dubai LLC (Limited Liability Company), shareholders enjoy the significant advantage of limited liability, which typically restricts their financial risk to their investment in the business. This protection is crucial, as it shields personal assets from the company's debts and liabilities. If the LLC faces financial challenges or legal actions, shareholders are generally not responsible for the company’s obligations beyond their initial capital contributions.

However, it's important to note that limited liability isn't absolute. In specific situations, shareholders may be held personally liable, particularly if they engage in unlawful or reckless behavior. For instance, if shareholders neglect corporate governance principles or partake in fraudulent activities, courts can pierce the corporate veil, making them personally accountable for the LLC's debts.

The legal framework governing a Dubai LLC mandates sound financial management and transparent accounting practices. Shareholders must ensure the company keeps accurate financial records and adheres to statutory requirements. Neglecting these responsibilities can lead to liability for unpaid taxes or penalties, which could extend to shareholders if the LLC is deemed negligent in its financial affairs.

Additionally, Dubai law offers protections for minority shareholders, with regulations in place to prevent majority shareholders from exploiting their power. This ensures that minority interests are safeguarded, granting them rights to information, participation in decision-making, and protection against unfair treatment, thereby enhancing their position within the company.

The articles of association for a Dubai LLC specify the rights and responsibilities of shareholders, including governance and decision-making processes. These foundational documents can provide additional layers of legal protection by clearly delineating the roles and responsibilities of shareholders, minimizing the risk of disputes and promoting harmony within the organization.

Seamless registration services are designed to simplify the business establishment process, allowing entrepreneurs to concentrate on their core activities. These services typically encompass a range of essential steps, including LLC name registration, acquiring necessary licenses, and obtaining tax identification numbers. By offering a streamlined approach, seamless registration services alleviate the complexities often associated with launching a business in Dubai.

Clients utilizing these services can expect tailored assistance that aligns with their specific needs. This includes personalized consultations to understand the unique requirements of their business structure, whether it's an LLC, partnership, or sole proprietorship. Experts guide clients through the necessary documentation and legal obligations, ensuring full compliance with local regulations.

A significant advantage of seamless registration services is the incorporation of technology to boost efficiency. Many providers utilize online platforms that enable clients to submit documents, monitor progress, and receive real-time notifications. This digital approach not only accelerates the registration process but also reduces the likelihood of errors or omissions that could hinder approval.

Furthermore, these services often come in comprehensive packages that extend support beyond the initial registration. This may include assistance with annual filings, changes in business structure, and updates to licenses or permits. Such ongoing support helps businesses maintain compliance as they evolve and expand.

Seamless registration services also provide insights into industry-specific regulations that may impact a business. Understanding these nuances equips entrepreneurs to navigate the complexities of their markets and avoid potential pitfalls. Access to expert guidance proves invaluable in maintaining compliance and fostering sustainable growth.

Ultimately, seamless registration services create a positive experience for entrepreneurs by minimizing stress and uncertainty. By taking care of the administrative burdens associated with business registration, these services empower clients to devote their time and resources to effectively building and expanding their businesses in Dubai.

Fill out the form below to register.

Registering your LLC (Limited Liability Company) with the Dubai Chamber of Commerce is a vital step in establishing your business in the UAE. The Chamber serves as the official registry for all companies in the region, ensuring transparent operations and compliance with legal requirements. This registration provides essential details about your company to the public, including its legal structure, activities, and financial status.

To kick off the registration process, gather all necessary documents. You'll typically need a valid identification document, your business plan, and information about the shareholders and directors. Additionally, you must specify the business activities you intend to pursue. It's important that these activities align with the codes used by the Chamber, as this will dictate your company's classification.

Once your documents are in order, schedule an appointment at your local Chamber of Commerce office. During this meeting, a representative will guide you through the registration process. You'll complete the registration form and provide the required documentation. The Chamber will then verify your information to ensure everything is accurate.

Upon successful registration, your LLC will receive a unique registration number, serving as your business identity within the Chamber system. This number is essential for various administrative tasks, including tax filings and opening a business bank account. You'll also receive an official extract from the register, which can be used as proof of your company’s existence.

After registration, it’s crucial to keep your Chamber information updated. Any changes to your company structure, such as shifts in directorship, shareholding, or business activities, must be reported to the Chamber promptly. This ensures compliance with UAE regulations and maintains the accuracy of the public registry.

Ensuring compliance with employment laws in Dubai is essential for a Limited Liability Company (LLC) to operate smoothly and avoid potential legal issues. One core aspect of Dubai’s employment regulations is the requirement for written employment contracts. These contracts should clearly outline terms such as job responsibilities, salary, working hours, and termination conditions. A well-crafted contract is crucial in helping both employers and employees understand their rights and responsibilities.

In Dubai, it’s equally important to adhere to minimum wage guidelines where applicable, ensuring fair compensation. Regular updates to wage regulations mean employers should remain informed to avoid penalties. Compliance with these guidelines reflects a commitment to fair labor practices, which is vital for the company’s reputation and legal standing.

Employee entitlements, including leave provisions such as annual vacation, sick leave, and parental leave, are also central to employment law compliance. Employers must meticulously track these entitlements and allow employees to take leave without facing any adverse consequences, as failure to do so can lead to reputational harm and legal repercussions.

Dubai’s employment laws also outline regulations around working hours and conditions, with rules on maximum hours, required rest periods, and fair overtime compensation. Establishing policies that align with these standards fosters a healthy work environment, enhancing employee satisfaction and minimizing labor disputes.

Understanding the corporate tax landscape in Dubai is essential for businesses aiming to thrive in this dynamic market. A key feature is the corporate tax rate, which is set at 9% for profits up to AED 375,000, making it highly attractive for small and medium-sized enterprises (SMEs). For profits exceeding this threshold, a rate of 15% applies. This progressive structure supports growth and sustainability for local businesses.

Another significant advantage is the participation exemption, enabling LLCs in Dubai to receive dividends and capital gains from subsidiaries tax-free, provided they hold at least 5% of the shares. This encourages companies to invest and expand internationally without the burden of additional taxes on repatriated profits.

Compliance is crucial in Dubai’s corporate tax framework. LLCs must submit their annual tax returns within nine months after the end of their financial year, with the option to request extensions. Accurate record-keeping is essential to avoid penalties, and companies have the flexibility to choose their fiscal year, allowing for strategic tax planning.

Dubai’s tax environment also promotes innovation and sustainability. Initiatives like the Innovation Fund incentivize companies that engage in research and development, offering reduced tax rates on qualifying income. This approach fosters a vibrant ecosystem for innovation.

For businesses operating internationally, understanding the implications of cross-border taxation is vital. Dubai has established an extensive network of tax treaties to mitigate double taxation and clarify tax responsibilities in various jurisdictions. Companies must also adhere to transfer pricing regulations, ensuring that intercompany transactions reflect fair market values.

To effectively navigate Dubai's corporate tax landscape, engaging local tax advisors is highly recommended. These professionals provide invaluable insights into compliance, strategic planning, and the latest tax reforms, empowering businesses to optimize their tax positions and achieve success in the region.

An LLC (Limited Liability Company) in Dubai must adhere to several ongoing obligations related to financial reporting and auditing. These requirements promote transparency, accuracy, and compliance with local corporate regulations. Here’s a breakdown of the key aspects:

An LLC is mandated to prepare and file annual financial statements within five months of the financial year-end. The shareholders must approve these statements in a general meeting within two months of preparation. The financial statements include a balance sheet, a profit and loss statement, and accompanying notes that clarify the financial data. Non-compliance can lead to penalties and potential legal liabilities for the company's directors.

Once the financial statements are approved, they must be submitted to the relevant authority in Dubai within eight days. The required level of detail in the publication is determined by the LLC’s size (small, medium, or large). For instance, small LLCs may be exempt from filing a complete balance sheet and are only required to submit a simplified version of their financials. Failing to meet these obligations could result in fines or legal repercussions.

Whether an LLC needs an audit depends on its size. Large and medium-sized LLCs are required to have their annual financial statements audited by an independent, certified auditor. Small LLCs are typically exempt from this requirement. The auditor’s role is to verify the accuracy of the financial statements, ensuring they present a true and fair view of the company’s financial standing.

Adhering to these obligations not only ensures compliance but also enhances the credibility of the LLC in the competitive business landscape of Dubai.

The LLC (Limited Liability Company) in Dubai is renowned for its structural flexibility, allowing businesses to customize their operations and governance to suit their unique requirements. This adaptability arises from the absence of minimum capital requirements, broad shareholder rights, and a customizable governance framework. Companies can effortlessly adjust their shareholding, capital distribution, and decision-making processes, making the LLC an appealing option for both small enterprises and larger corporations seeking operational agility and opportunities for international growth.

Define the Shareholder Structure: Start by determining the shareholders and their respective ownership percentages. An LLC can have one or more shareholders, whether individuals or legal entities, providing flexibility in establishing control over the company.

Draft and Sign the Articles of Association: The articles of association lay out the governance of the LLC, including management structures, voting rights, and dividend policies. These can be tailored to align with the specific preferences of shareholders and management, ensuring clear operational guidelines.

Appoint Directors and Define Roles: Directors can be appointed with diverse roles and responsibilities. The LLC structure permits the appointment of both executive and non-executive directors, enhancing management flexibility.

Determine Capital Contributions: With no minimum capital requirement for establishing an LLC, there’s significant freedom in how the company’s capital is structured. Shares can be issued with or without voting rights, and various classes of shares can be created to suit different strategic objectives.

Establish Voting Rights and Decision-Making Processes: Shareholders can customize voting rights within the LLC. Different classes of shares may carry different voting powers, and specific decisions might necessitate a higher voting threshold, allowing for tailored governance.

Register the LLC with the Dubai Economic Department: Once the structure is finalized, the LLC must be registered with the Dubai Economic Department. This formal registration process includes detailing the shareholder structure and other key information.

Ensure Compliance with Dubai Corporate Regulations: Post-registration, the LLC must adhere to Dubai’s corporate regulations, including annual reporting and tax obligations. The company should operate according to its articles of association while ensuring compliance with local laws, thus retaining the flexibility that makes it attractive for entrepreneurs and investors.

This structural adaptability makes the LLC in Dubai an ideal choice for ambitious entrepreneurs and investors aiming to thrive in a dynamic business environment.

Leveraging a virtual office address for your LLC in Dubai can be a savvy and practical choice, especially for startups and small enterprises. This approach enables you to establish a business presence in Dubai without the need for a physical office, significantly lowering operational expenses and making it an appealing option for companies aiming to enter the market.

A key advantage of a virtual office is the provision of a professional business address, which can elevate your company's credibility. This is crucial when engaging with local clients or partners who anticipate a presence in the area. Additionally, a virtual office helps keep your personal address confidential, ensuring a distinct boundary between your business and personal life.

Beyond enhancing credibility, a virtual office address can also assist in fulfilling legal requirements for establishing an LLC in Dubai. Local regulations mandate that an LLC must have a registered address within the jurisdiction. A virtual office effectively meets this requirement, allowing businesses to comply with local laws without needing to lease or purchase physical office space.

Virtual office services often extend beyond just an address. Many providers offer features such as mail forwarding and phone answering, ensuring that you never miss essential communications while operating remotely. Some even provide meeting rooms and coworking spaces, allowing you to engage with clients or partners in a professional environment when necessary.

For businesses with international operations, having a virtual office in Dubai can simplify cross-border transactions. It establishes a local point of contact, which can facilitate building relationships with clients, suppliers, and partners in the region. This localized presence opens doors to valuable business networks and resources.

Tax efficiency is another significant benefit of utilizing a virtual office. With a registered business address in Dubai, your LLC may qualify for certain local tax benefits or deductions. Moreover, Dubai boasts an attractive corporate tax landscape, making this setup even more appealing.

Flexibility is a major asset of a virtual office. Whether you're looking to expand into new markets or scale back operations, a virtual office allows you to adapt swiftly without the complexities of physical office leases. This adaptability is especially advantageous in today’s dynamic business environment.

In terms of administrative efficiency, a virtual office can streamline your operations. Many providers offer digital tools to manage mail, scheduling, and communication, enabling you to concentrate on core business activities. This convenience liberates valuable time for entrepreneurs and managers.

In summary, opting for a virtual office for your LLC in Dubai is a cost-effective and adaptable solution that enhances professionalism, compliance, and operational efficiency for your business.

Registering an LLC (Limited Liability Company) in Dubai can be a complex journey, particularly for foreign entrepreneurs unfamiliar with local laws and regulations. Collaborating with local experts can significantly simplify this process, ensuring full compliance with all legal requirements while offering valuable insights into the Dubai market. These professionals help navigate the necessary paperwork, verify required documentation, and liaise with local authorities, allowing you to concentrate on your business. With their expertise, the registration process becomes faster, smoother, and more efficient, minimizing the risk of costly mistakes or delays.

Engage with local consultants specializing in LLC registration to gain a clear understanding of the requirements, procedures, and potential challenges. They will outline the necessary steps and provide an initial assessment tailored to your business needs.

With expert guidance, prepare essential documents such as your business plan, shareholder details, and proof of identification. Local professionals ensure that all paperwork meets Dubai's legal standards.

Local experts will assist you in selecting an appropriate company name and verifying its availability with the relevant Dubai authorities to avoid any potential conflicts.

Collaborate with a local notary, as required by law, to draft and notarize your articles of association. Local consultants will help ensure these documents align with Dubai's legal norms and your business objectives.

Local experts can facilitate the opening of a Dubai business bank account, a crucial step for depositing your required share capital. They streamline communication with banks, ensuring a smoother process.

Once all documents are prepared, your local experts will assist you in submitting the registration to the appropriate Dubai authorities, ensuring all details are correct and avoiding delays.

After registration, local consultants will help you apply for a UAE VAT number and ensure your business complies with local tax laws. They can also provide ongoing advice on reporting and compliance requirements.

By partnering with local experts, your journey to registering an LLC in Dubai can be not only efficient but also rewarding, setting a strong foundation for your business success.

Leveraging technology in business registration services has transformed the process into a streamlined and efficient experience. Gone are the days of cumbersome paperwork, prolonged waiting times, and multiple trips to government offices. With the advent of digital platforms, businesses can now register online, significantly cutting down the time and effort required by entrepreneurs.

A standout benefit of incorporating technology into business registration is the automation of various processes. Automated systems provide step-by-step guidance throughout the registration journey, ensuring all necessary forms and documents are accurately completed. This not only reduces the likelihood of human error but also enhances the precision of submitted information.

Cloud-based platforms have been pivotal in modernizing registration services. Entrepreneurs can now securely store and access their documents online, allowing them to retrieve their registration details anytime, anywhere. This flexibility fosters a more convenient and user-friendly experience.

The introduction of e-signatures has also revolutionized document signing and submission during the registration process. By eliminating the need for physical signatures, e-signatures accelerate approval times and decrease reliance on paper-based systems, which often face delays.

Furthermore, technology has enhanced transparency within business registration services. Entrepreneurs can monitor the progress of their applications in real-time, fostering trust in the system and keeping businesses informed about potential delays or additional documentation requirements.

Artificial intelligence (AI) plays a vital role in refining the registration process. AI tools can analyze submitted documents for compliance, ensuring they meet all regulatory requirements before submission. This proactive approach saves time and reduces the risk of rejection.

Moreover, integrated online payment systems within registration platforms facilitate seamless transactions, allowing entrepreneurs to pay their registration fees digitally. This eliminates the need for traditional payment methods like checks or cash.

Finally, technology has significantly improved accessibility for small businesses and startups. Entrepreneurs, even in remote areas, can easily access registration services without the need to travel, encouraging business growth across a broader spectrum in Dubai.

An LLC (Limited Liability Company) is a private limited liability entity that provides numerous advantages for both local and foreign entrepreneurs in Dubai. This business structure is favored for its flexibility, limited liability for members, and straightforward regulations. An LLC can be established with a minimal share capital requirement, making it an attractive option for small businesses and startups. Members are only liable up to the value of their shares, ensuring personal financial protection. Additionally, an LLC benefits from favorable tax conditions and the ability to draw in investors through share offerings.

The primary distinction between an LLC and a sole proprietorship lies in the level of liability. In a sole proprietorship, the owner bears personal responsibility for all business debts and obligations, which puts personal assets at risk if the business faces financial challenges. In contrast, an LLC restricts liability to the entity itself, safeguarding members from personal exposure. Moreover, an LLC offers enhanced tax planning strategies, whereas sole proprietorships, while easier to set up, may incur higher personal tax rates.

A Public Limited Company (PLC) is another widely used business structure, primarily suited for larger corporations. Unlike an LLC, which is privately held, a PLC can issue shares to the public and is eligible for listing on the stock exchange. This structure is ideal for larger enterprises aiming to raise capital through public offerings. However, establishing a PLC demands a higher minimum capital investment and involves more complex administrative obligations. On the other hand, an LLC is often the preferred choice for small and medium-sized enterprises (SMEs) due to its simpler formation and lower capital requirements.

Partnerships, such as general partnerships or limited partnerships, represent another common business structure in Dubai. In a general partnership, all partners share personal liability for the business’s debts, similar to a sole proprietorship. A limited partnership offers liability protection for limited partners but not for general partners. In contrast, an LLC provides a protective shield of limited liability for all members. Partnerships are frequently chosen for straightforward operations or family businesses, while an LLC is more suitable for companies seeking growth, attracting investors, or expanding internationally.

With its array of benefits, an LLC in Dubai stands out as a powerful option for entrepreneurs aiming for success in the dynamic business landscape.

Am I prepared to launch my Entity?

I am prepared to begin trading.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!