One Control Panel to handle your company's incorporation and other corporate challenges during your global expansion. House of Companies offers the most cost-effective and efficient way to incorporate your company overseas, including the tools and community to ensure a successful market entry in Dubai.

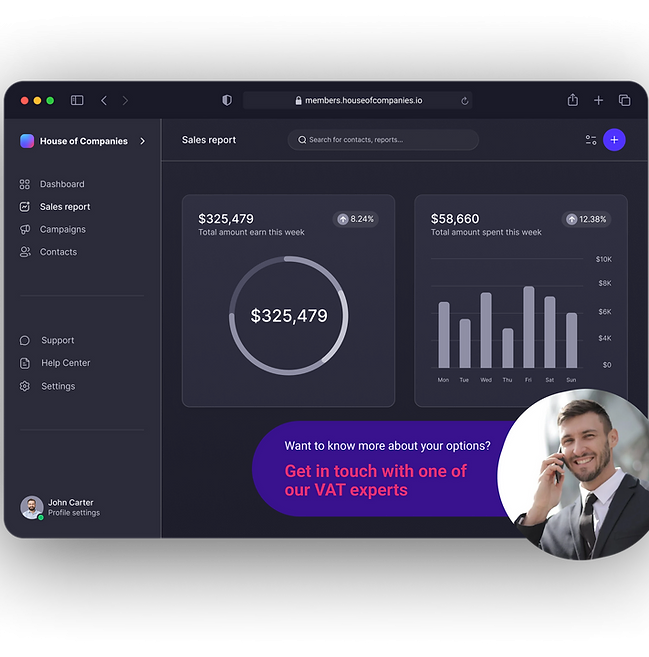

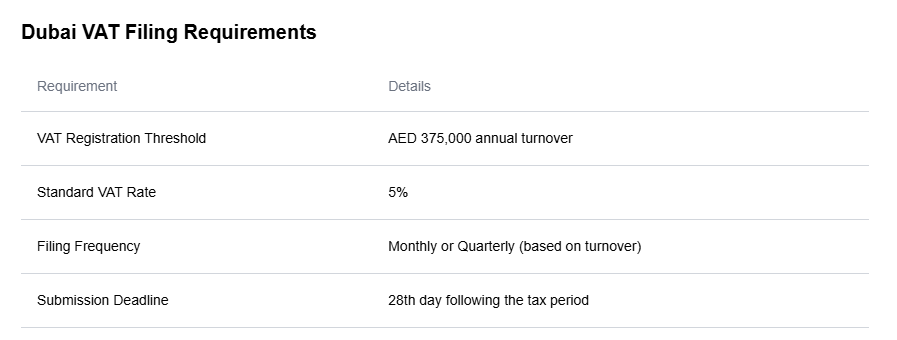

Filing your VAT returns in Dubai is becoming increasingly straightforward. The Federal Tax Authority (FTA) provides an online tax portal for international business owners, simplifying the VAT return submission process. When you sign up for a Free Trial, you can use our Entity Management to submit your VAT return in compliance with Dubai regulations.

Once your first VAT return is submitted, you can continue using Entity Management to run & grow your company in Dubai!

"I was skeptical about filing my VAT return on my own, but Entity management services provided exceptional support. They handled everything with professionalism, making the process stress-free."

John P

John PThe streamlined VAT filing process made everything so much easier. Their support is top-notch, and I can’t recommend them enough for anyone looking to enter the Spanish market.

Carlos RiveraOperations Manager

Carlos RiveraOperations ManagerTestimonial 3

John SmithCEO

John SmithCEO"I’ve worked with other services before, but none compare to the efficiency and reliability of Entity Management services. My VAT return was filed on time, and the process was so smooth!"

Ahmed T

Ahmed T"I highly recommend Entity management service for VAT filing in Dubai. Their team is knowledgeable, friendly, and committed to providing a smooth experience. I will definitely use their services again!"

Tania EcheverríaFinancial Director

Tania EcheverríaFinancial DirectorFiling your VAT return in Dubai can be a complex process, but you don't have to do it alone.

Whether you're a local business or an international entity operating in Dubai, having the right support is essential for compliance and peace of mind.

Our experienced team is ready to assist you every step of the way. You can provide us with your existing ledgers and VAT analysis, or we can create comprehensive records tailored to your specific needs.

Don’t let VAT filing stress you out—submit your VAT return in Dubai with confidence today! Reach out now to get started!

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!