At House of Companies Dubai, we specialize in providing comprehensive services that assist e-commerce entrepreneurs in streamlining and automating the VAT return process, making selling within the UAE and beyond more seamless.

With our expert solutions tailored to Dubai's regulations, you save time and money while eliminating the complexities of VAT compliance. Focus on expanding your business globally without the burden of international tax concerns.

House of Companies Dubai provides comprehensive solutions for e-commerce entrepreneurs to streamline sales in the UAE and internationally. By optimizing and automating the VAT return process in accordance with Dubai regulations, we enable seamless expansion into new markets without the burden of complex tax compliance.

Our Services

With our services, you can focus on growing your business in Dubai and beyond without the complexities of UAE tax compliance holding you back!

"Partnering with House of Companies has transformed how we handle VAT. Their automated solutions have not only simplified the process but have also saved us countless hours each month. Highly recommend!"

Ahmed Al-Mansoori

Ahmed Al-Mansoori"Thanks to the automated VAT services, I can now dedicate more time to my customers and less time on tax issues. House of Companies has truly been a partner in our growth."

Khalid Ali

Khalid Ali"We were struggling with VAT compliance until we reached out to House of Companies. Their expertise and automated solutions have streamlined our operations, making VAT filing quick and efficient."

Zainab Al-Banna

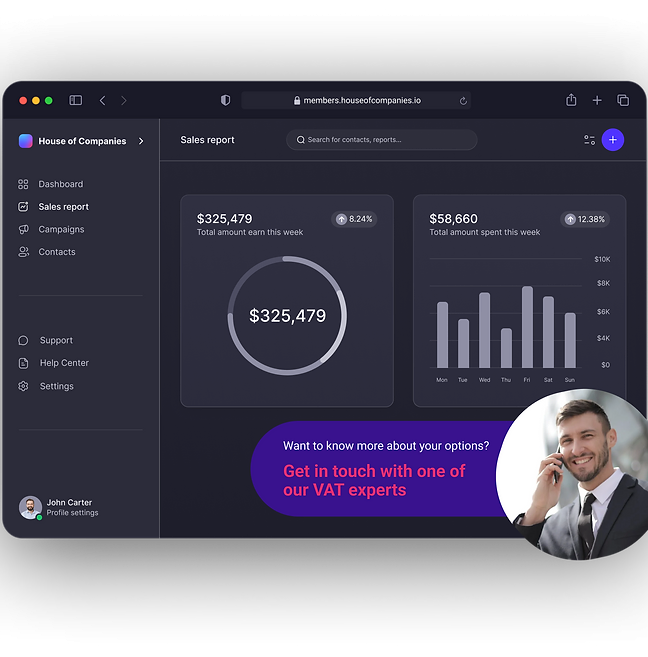

Zainab Al-BannaPartnering with our VAT experts at House of Companies Dubai allows you to leverage the benefits of automation while receiving personalized support to navigate the intricacies of UAE VAT compliance. Contact us today to explore how our dedicated VAT support can elevate your automated VAT process and drive financial efficiency for your business in Dubai.

At House of Companies Dubai, we understand the challenges businesses face in navigating the complex landscape of VAT compliance in the UAE. Our team of VAT experts provides specialized assistance to complement your automated VAT process, ensuring accuracy and efficiency in compliance with Dubai and UAE regulations.

Comprehensive VAT Consultancy: Guidance on UAE VAT matters, from initial FTA registration to cross-border transactions and complex issues such as tax audits.

Tailored VAT Planning: Customized VAT planning advice, including structuring transactions to optimize cash flow within UAE legal framework.

International VAT Guidance: Expertise in VAT on international services, navigating rules governing business transactions in Dubai's Free Zones and beyond.

Error Correction and Compliance: Assistance in rectifying VAT errors and ensuring compliance with FTA regulations, reducing the risk of penalties.

Increased Visibility: Our experts provide ongoing visibility into the status of your VAT claims and offer insights to enhance your compliance rates.

Guaranteed Compliance: We ensure that only accurate and compliant claims are filed, safeguarding your finances and minimizing the risk of fines.

Optimal Results: With our support, you can maximize your VAT reclaim potential, leading to increased profitability for your business.

Learn More →

Learn More →

Learn More →

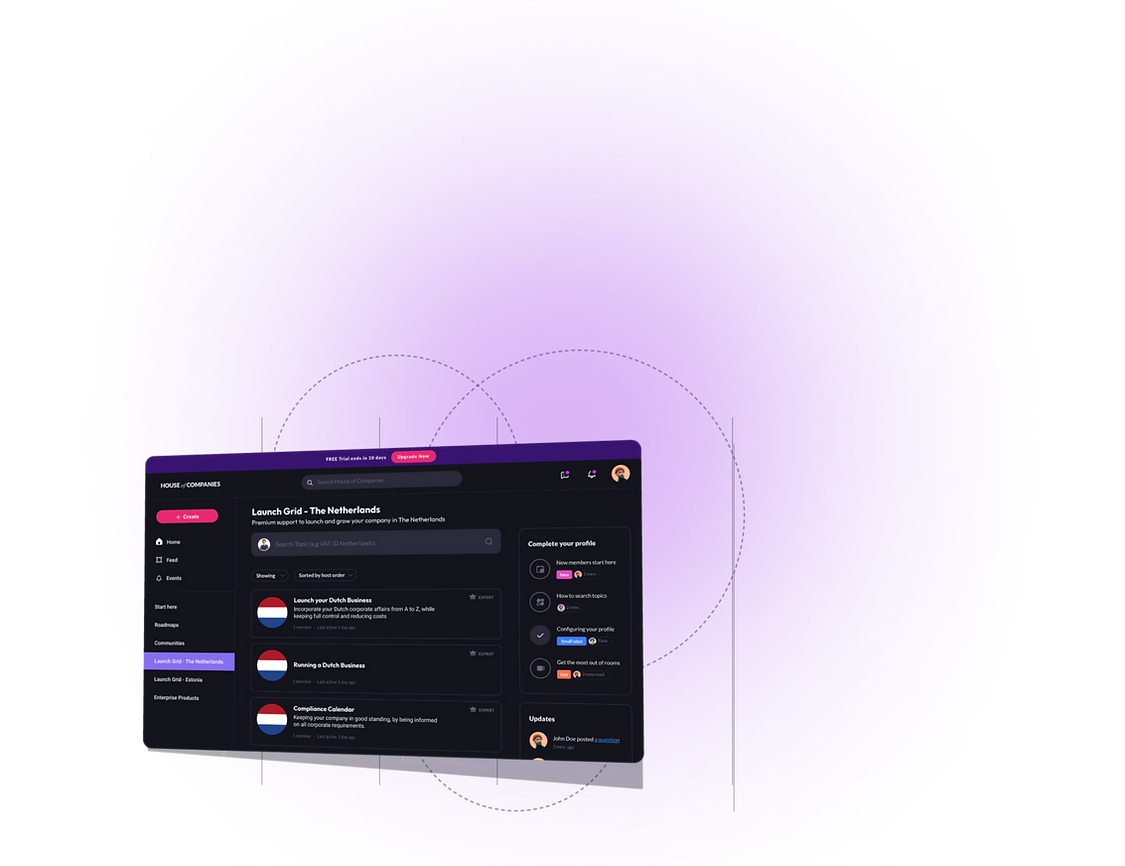

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!