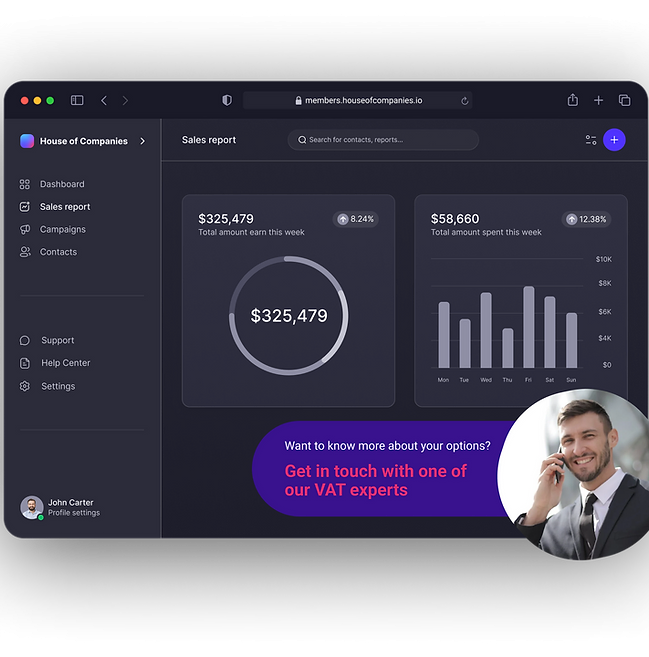

Managing your corporate tax filing and overcoming corporate hurdles during your global expansion has never been easier. With our streamlined solution, you can file your corporate tax return in Dubai efficiently and cost-effectively, without the need for overseas tax lawyers. Maintain full control of your filings, either independently or alongside your current accountant.

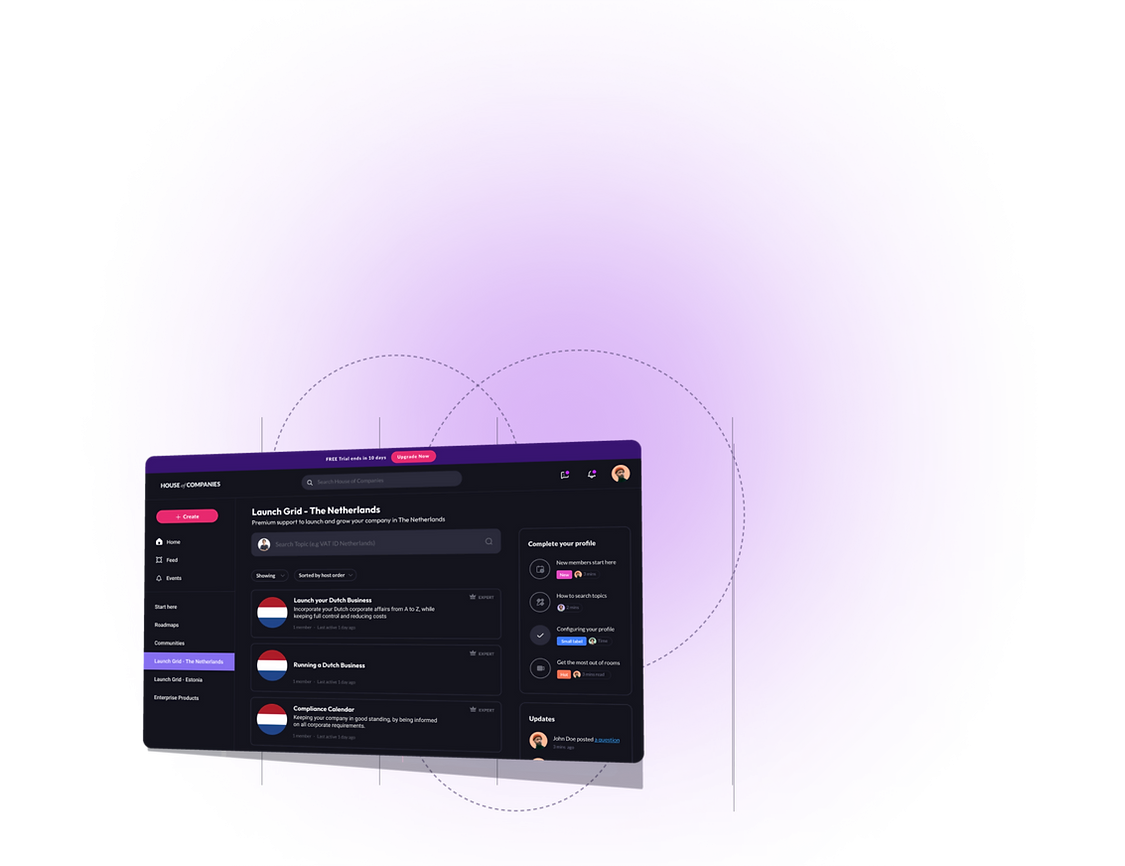

Filing your corporate tax returns in Dubai is becoming increasingly straightforward. With a growing number of online tax portals available, global entrepreneurs can streamline their corporate tax return submission process. Try our Entity Management system during a Free Trial to file your corporate tax return seamlessly. Once your corporate tax return is filed, you can leverage Entity Management to further run and grow your company in Dubai!

"Their Entity Management platform helped us set up our bank accounts quickly and efficiently, saving our team time and resources. Highly recommend them for any new business in Dubai!"

John S

John S"The team at Submit Your Corporate Tax Return is extremely knowledgeable about Dubai tax laws and entity management. They handled everything with precision, saving us valuable time and money!"

Carlos Martinez

Carlos Martinez"Their expertise in corporate tax filing and entity management services in Dubai is outstanding. We highly recommend Submit Your Corporate Tax Return for businesses looking to simplify their tax process!"

Patricia Sanchez

Patricia SanchezWhile our Entity Management solution is the primary offering, we understand that some situations in Dubai may require the involvement of a local tax expert. In certain cases, a local accountant is legally required to handle corporate tax filings. House of Companies can assist you in submitting your tax return in Dubai, whether you provide us with your ledgers, Profit & Loss statement, or Balance Sheet, or if you need us to start from scratch.

Our International Tax Officers can facilitate you in dealing with complex and personal tax affairs that may not be covered by the Entity Management platform (although these capabilities are constantly expanding for the UAE market).

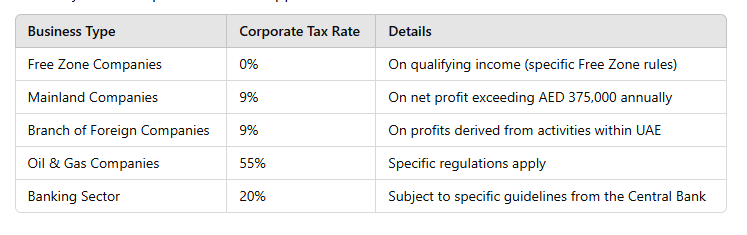

Corporate Tax Rates in Dubai

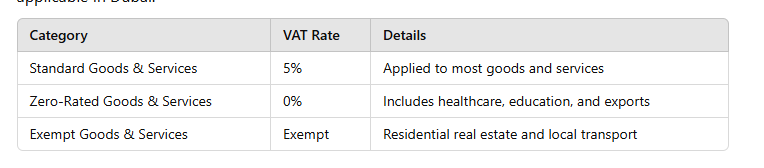

Value-Added Tax (VAT) in Dubai

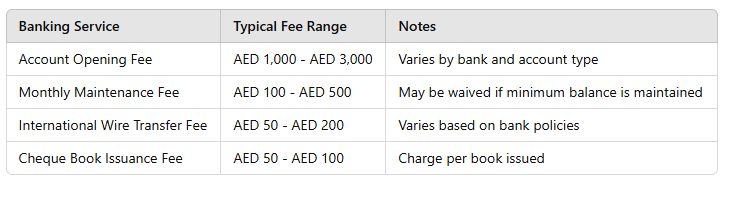

Banking Charges & Fees in Dubai

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!