Our Entity Management services span globally, offering robust support for businesses in both EU and non-EU countries, with a primary focus on Dubai. We assist companies in establishing, maintaining, and managing their legal entities, ensuring full compliance with local regulations, governance standards, and corporate laws.

With our VAT Reporting services, your business will adhere to all relevant VAT regulations, streamlining your operations and minimizing the risk of fines or penalties.

Let's take your business to the next level!

"I anticipated it would take around two quarters to start generating revenue in Dubai. Fortunately, I was able to do this without incurring any expenses for an accountant along the way."

John Smith

John Smith"With my trusted Indian accountant at the helm, my VAT reports are expertly crafted and seamlessly submitted through our Dubai-based entity management service!"

Deny

Deny"Understanding the ins and outs of entity management gave me the confidence to take charge of my tax filings in Dubai, and it truly made a difference!"

Rose

RoseEverything you need to know about VAT requirements for starting your new business.

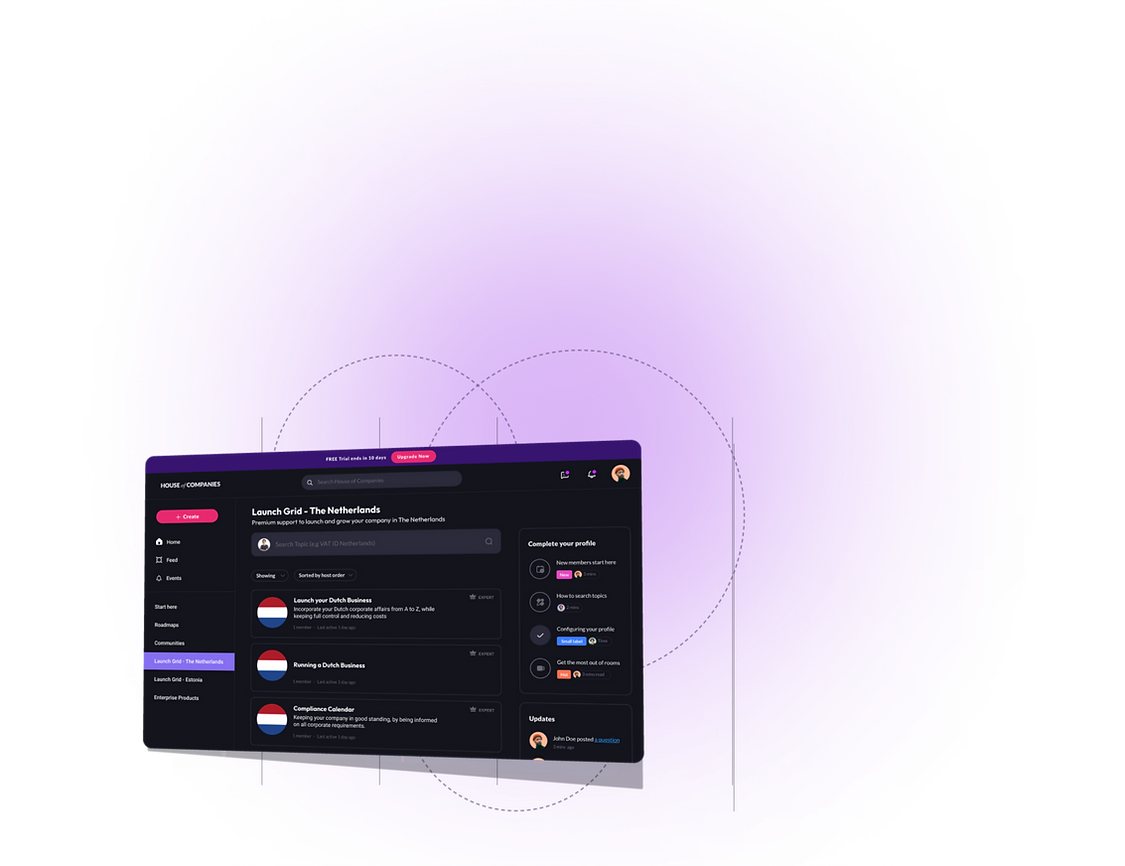

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!