Introduction

Welcome to the Complete Guide to Branch Registration in the Netherlands – 2023 Entity Management Portal! In this comprehensive article, we will walk you through all the important steps and requirements for registering a branch in the Netherlands. Whether you are a multinational corporation expanding your operations or an entrepreneur looking to establish a presence in this vibrant European country, this guide is your go-to resource.

The Netherlands offers an attractive business environment, with its robust economy, strategic location, and favorable tax climate. However, navigating the branch registration process can be complex and time-consuming. That’s where the 2023 Entity Management Portal comes in. This innovative digital platform streamlines the entire registration process, enabling companies to submit all the necessary documentation online, track their application status, and receive notifications in real time.

Our expert team has compiled all the latest information and insights to ensure that you have a stress-free and successful branch registration experience. From preparing the required documents to understanding the legal and tax implications, we’ve got you covered.

Don’t let the bureaucracy hold you back. Let’s dive in and unlock the potential of doing business in the Netherlands through branch registration.

Understanding The Entity Management Portal

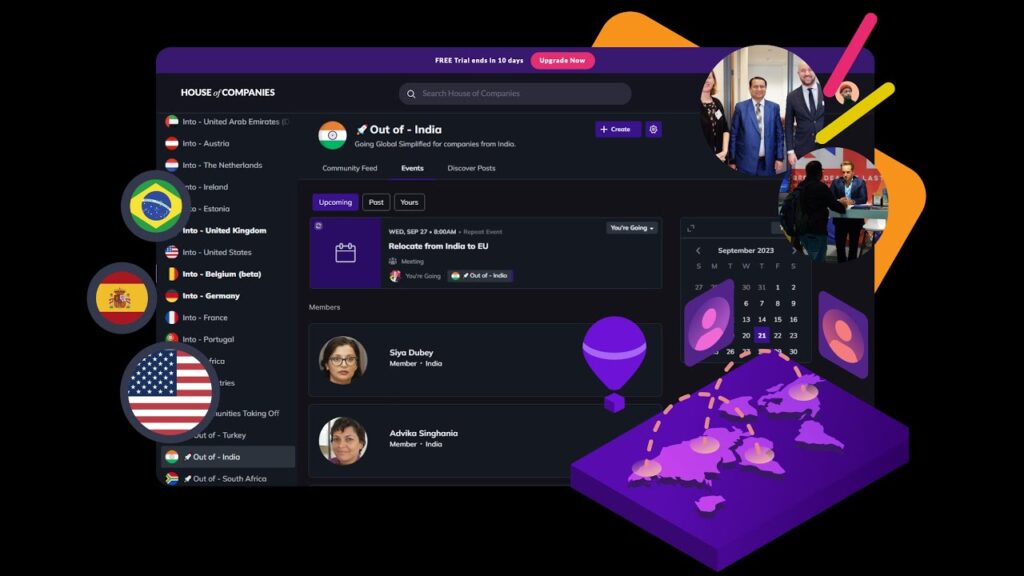

The Entity Management Portal is a groundbreaking digital platform that revolutionizes the way companies register their branches in the Netherlands. This user-friendly online system replaces the traditional paper-based process and offers a host of benefits for businesses. By leveraging cutting-edge technology, the Entity Management Portal simplifies and accelerates the branch registration process, saving companies valuable time and resources.

One of the key advantages of the Entity Management Portal is its accessibility. Companies can access the platform from anywhere in the world, eliminating the need for physical presence during the registration process. This is particularly advantageous for multinational corporations that have branch offices in multiple countries. With the Entity Management Portal, they can manage the branch registration process seamlessly and efficiently from a centralized location.

Furthermore, the Entity Management Portal provides a centralized repository for all the required documentation. Companies can upload and submit all the necessary forms, agreements, and supporting documents electronically, eliminating the need for cumbersome paperwork. The platform also allows for easy tracking of the application status, ensuring transparency and accountability throughout the registration process.

In addition to streamlining the registration process, the Entity Management Portal offers valuable resources and information to guide companies through the branch registration journey. From FAQs to step-by-step guides, companies can access comprehensive information and support to ensure a smooth and successful registration experience.

Benefits Of Registering A Branch In The Netherlands

Registering a branch in the Netherlands offers numerous benefits for businesses looking to expand their operations or establish a presence in Europe. Here are some of the key advantages:

1. Access To The European Market: The Netherlands is strategically located in the heart of Europe, providing businesses with easy access to the European market. With its well-developed infrastructure and efficient logistics, companies can reach customers and suppliers across the continent quickly and cost-effectively.

2. Stable And Business-Friendly Environment: The Netherlands boasts a stable political and economic environment, making it an attractive destination for businesses. The country has a strong rule of law, transparent governance, and a business-friendly regulatory framework. This stability provides certainty and confidence for companies operating in the Netherlands.

3. Highly Skilled Workforce: The Netherlands is known for its highly educated and multilingual workforce. With a strong emphasis on innovation and technology, the country offers access to a pool of talented professionals across various sectors. This skilled workforce is a valuable asset for businesses looking to drive growth and innovation.

4. Favorable Tax Climate: The Netherlands has a competitive tax regime that is designed to attract foreign investment. The country offers various tax incentives and favorable tax rates for businesses, making it a tax-efficient jurisdiction for companies operating internationally. Additionally, the Netherlands has an extensive network of double taxation treaties, providing further tax advantages for businesses.

These are just some of the benefits that businesses can enjoy by registering a branch in the Netherlands. The country’s strategic location, stable business environment, skilled workforce, and favorable tax climate make it an ideal destination for companies looking to expand their global footprint.

Requirements For Branch Registration

Before you embark on the branch registration process, it is important to understand the requirements set by the Dutch authorities. Meeting these requirements is crucial to ensure a smooth and successful registration experience. Here are the key requirements for branch registration in the Netherlands:

1. Registration With The Chamber Of Commerce (KVK): All branches operating in the Netherlands are required to register with the Chamber of Commerce (KVK). The KVK is the official registry for businesses in the Netherlands and plays a vital role in the branch registration process. To register your branch, you will need to provide certain information, such as the branch’s name, legal form, address, and contact details.

2. Appointment Of A Local Representative: As part of the branch registration process, you will need to appoint a local representative who is authorized to act on behalf of the branch. This representative can be an individual or a legal entity, and their role is to serve as a contact person for the branch and liaise with the Dutch authorities.

3. Financial Statements: Companies registering a branch in the Netherlands are required to submit their financial statements. These statements should provide a clear overview of the company’s financial position and performance. The financial statements should be prepared in accordance with the Dutch accounting standards and include an auditor’s report, if applicable.

4. Proof Of Legal Existence: Companies registering a branch in the Netherlands must provide proof of their legal existence. This can be done by submitting the company’s articles of association or an extract from the commercial register of the country of origin. The document should clearly indicate the company’s name, legal form, registered address, and details of the authorized representatives.

Step-By-Step Process Of Branch Registration

Now that you are familiar with the requirements, let’s walk through the step-by-step process of branch registration in the Netherlands. By following these steps, you can ensure a smooth and efficient registration process:

1. Gather The Required Documents: Before you begin the registration process, gather all the necessary documents and information. This includes the company’s articles of association, financial statements, proof of legal existence, and the appointment letter for the local representative.

2. Create An Account On The Entity Management Portal: Visit the Entity Management Portal website and create an account. This will give you access to the digital platform, where you can submit your registration application and track its progress.

3. Complete The Online Registration Form: Fill out the online registration form with the required information, such as the branch’s name, legal form, address, and contact details. Upload the necessary documents and provide any additional information as requested.

4. Pay The Registration Fee: The branch registration process involves a registration fee, which can be paid online through the Entity Management Portal. The fee may vary depending on the type and size of the branch.

5. Review And Submit The Application: Review all the information and documents to ensure accuracy and completeness. Once you are satisfied, submit the application through the Entity Management Portal.

6. Track The Application Status: Use the Entity Management Portal to track the status of your application. You will receive notifications and updates in real time, keeping you informed about the progress of your registration.

7. Receive The Registration Certificate: Once your application is approved, you will receive a registration certificate from the Chamber of Commerce. This certificate serves as proof of the branch’s registration and should be kept for future reference.

By following these steps and utilizing the Entity Management Portal, you can streamline the branch registration process and ensure a hassle-free experience.

Documents And Information Needed For Branch Registration

During the branch registration process, you will be required to provide certain documents and information. It is important to gather these documents in advance to avoid any delays or complications. Here is a list of the key documents and information needed for branch registration in the Netherlands:

1. Articles Of association: Provide a copy of the company’s articles of association. This document outlines the company’s purpose, structure, and internal regulations.

2. Financial Statements: Submit the company’s financial statements, including the balance sheet, profit and loss statement, and cash flow statement. These statements should be prepared in accordance with the Dutch accounting standards.

3. Proof Of Legal Existence: Provide proof of the company’s legal existence, such as the company’s articles of association or an extract from the commercial register of the country of origin.

4. Appointment Letter For The Local Representative: Include a letter of appointment for the local representative who will act on behalf of the branch. The letter should clearly state the representative’s name, contact details, and the scope of their authority.

5. Branch Address And Contact Details: Provide the branch’s address, contact details, and any other relevant information, such as the branch’s activities and target market.

6. Identification Documents: Submit copies of the identification documents for the authorized representatives of the branch, such as passports or identity cards.

7. Power Of Attorney: If the branch’s authorized representatives are not able to sign the registration documents in person, a power of attorney may be required. This document authorizes another person to sign on their behalf.

By ensuring that you have all the necessary documents and information ready, you can expedite the branch registration process and avoid any unnecessary delays.

Common Challenges And How To Overcome Them

While registering a branch in the Netherlands offers numerous benefits, it is not without its challenges. Here are some common challenges that businesses may face during the branch registration process and how to overcome them:

1. Language Barrier: The official language in the Netherlands is Dutch, which can be a challenge for non-Dutch speaking businesses. To overcome this, it is advisable to work with a local expert or engage the services of a professional translation service to ensure accurate and effective communication.

2. Complex Legal And Tax Requirements: The legal and tax requirements for branch registration in the Netherlands can be complex and vary depending on the nature of the business. It is recommended to seek professional advice from a legal or tax expert who is familiar with the Dutch regulations and can guide you through the process.

3. Navigating The Entity Management Portal: While the Entity Management Portal is designed to simplify the branch registration process, some businesses may find it challenging to navigate the platform. To overcome this, take advantage of the resources and support available on the portal, such as user guides and FAQs. You can also reach out to the helpdesk for assistance.

4. Managing multiple registrations: If your company operates in multiple countries and intends to register branches in the Netherlands, managing the registration process can be complex. It is essential to have a clear understanding of the requirements and timelines for each registration and establish a centralized system to track and manage the process effectively.

By anticipating these challenges and seeking the necessary support and guidance, you can overcome them and ensure a successful branch registration experience in the Netherlands.

Best practices for managing your registered branch

Once your branch is registered in the Netherlands, it is important to implement best practices for managing and operating your branch effectively. Here are some key practices to consider:

1. Compliance With Local Regulations: Familiarize yourself with the local laws and regulations that govern your business activities in the Netherlands. Ensure that your branch is fully compliant with these regulations and regularly monitor for any changes or updates.

2. Maintain Accurate Financial Records: Keep accurate and up-to-date financial records for your branch. This includes maintaining proper accounting books, recording all financial transactions, and preparing regular financial statements in accordance with the Dutch accounting standards.

3. Establish Strong Internal Controls: Implement robust internal controls to safeguard your branch’s assets and prevent fraud or misuse. This includes segregation of duties, regular monitoring of financial activities, and implementing effective risk management practices.

4. Stay Informed About Tax Obligations: Stay up-to-date with your tax obligations in the Netherlands. This includes timely filing of tax returns, payment of taxes, and compliance with any tax reporting requirements. Consider engaging the services of a tax professional to ensure compliance and optimize your tax position.

5. Establish Effective Communication Channels: Maintain open and effective communication channels between your branch and the head office or other branches. Regularly communicate with key stakeholders, share information, and seek their input and feedback.

6. Monitor And Evaluate Performance: Regularly monitor and evaluate the performance of your branch. Set clear goals and targets, track key performance indicators, and make necessary adjustments to optimize the branch’s performance and profitability.

By implementing these best practices, you can ensure that your registered branch in the Netherlands operates efficiently, complies with the local regulations, and contributes to the overall success of your business.

FAQs About Branch Registration In The Netherlands

1. Do I Need To Have A Physical Office In The Netherlands To Register A Branch?

No, you do not need to have a physical office in the Netherlands to register a branch. However, you will need to provide a local address as the branch’s registered address.

2. Can I Register A Branch In The Netherlands If My Company Is Not Incorporated In The EU?

Yes, companies from outside the EU can register a branch in the Netherlands. However, additional requirements and documentation may be necessary.

3. How Long Does The Branch Registration Process Take?

The duration of the branch registration process can vary depending on various factors, such as the complexity of the application and the workload of the authorities. On average, it takes around 2-4 weeks to complete the registration process.

4. Can I Change The Registered Address Of My Branch After Registration?

Yes, it is possible to change the registered address of your branch after registration. However, you will need to follow the necessary procedures and notify the Chamber of Commerce.

5. Do I Need To Have A Local Bank Account For My Branch?

Having a local bank account for your branch is not mandatory. However, it is recommended to have a local bank account to facilitate financial transactions and business operations in the Netherlands.

6. What Are The Ongoing Compliance Requirements For Registered Branches In The Netherlands?

Registered branches in the Netherlands are required to comply with various ongoing obligations, such as filing annual financial statements, notifying the Chamber of Commerce about any changes in the branch’s details, and complying with tax obligations.

7. Can I Close Or Deregister My Branch In The Netherlands?

Yes, you can close or deregister your branch in the Netherlands if you no longer wish to operate it. You will need to follow the necessary procedures and notify the Chamber of Commerce.

Conclusion: Streamlining Your Branch Registration Process

Registering a branch in the Netherlands can be a rewarding and strategic move for businesses looking to expand their global presence. The robust economy