In Dubai, a notary plays a significant role in the company formation process, particularly in ensuring that all legal documents are properly authenticated and comply with local regulations. Here’s how a notary contributes to the formation of a company in Dubai:

Authentication of Documents

A notary in Dubai is responsible for authenticating various documents required for company formation. This includes the Memorandum of Association (MOA) and Articles of Association, which outline the company’s structure, activities, and governance. The notary ensures that these documents are legally binding and meet the standards set by the Dubai Department of Economic Development (DED) or the relevant free zone authority.

Verification of Identity

The notary verifies the identities of the company’s founders, shareholders, and directors. This involves checking the validity of identification documents, such as passports or national ID cards, to ensure that all parties involved are legitimate and authorized to establish the business. This step is crucial in preventing fraud and ensuring transparency in the company formation process.

Legal Compliance and Advisory

Notaries provide guidance on compliance with Dubai’s legal and regulatory requirements. They advise entrepreneurs on the necessary steps to establish a company, including the preparation of documents and adherence to local laws. This advice is invaluable for foreign investors who may be unfamiliar with Dubai’s legal landscape.

Execution of Legal Documents

The notary oversees the execution of legal documents, ensuring that all parties understand their rights and obligations. This includes witnessing the signing of the MOA and other critical documents, which are then submitted to the DED or the relevant authority for approval.

Facilitating Registration

While not directly responsible for registering the company, the notary’s role in authenticating and verifying documents is essential for the registration process. Once the documents are notarized, they can be submitted to the appropriate authorities to obtain the necessary licenses and approvals for the company to operate legally in Dubai.

In summary, a notary in Dubai plays a crucial role in the company formation process by authenticating documents, verifying identities, ensuring legal compliance, and facilitating the execution of necessary legal documents. Their involvement helps ensure a smooth and transparent establishment of a business entity in Dubai.

Registering your company with the DED is a crucial step in establishing a business in Dubai. This process ensures that your business is legally recognized and compliant with UAE laws and regulations. Before you begin, it's essential to determine your business structure (e.g., LLC, sole proprietorship, free zone company), as this will affect your registration process and obligations.

Choose a Business Structure:

Decide on the legal form of your company, such as a Limited Liability Company (LLC), sole proprietorship, or free zone company. Your choice will depend on your business needs and plans.

Prepare Required Documents:

Select a Business Name:

Choose a unique name for your company that complies with UAE naming regulations. Ensure it is not already in use by checking the DED’s business name database.

Apply for Initial Approval:

Submit an initial approval application to the DED. This step confirms that the DED has no objection to your business operations in Dubai.

Draft the Memorandum of Association (MoA):

Prepare the MoA, which outlines the company’s structure and the rights and responsibilities of the partners. This document must be notarized by a public notary.

Obtain Additional Approvals:

Depending on your business type, you may need additional approvals from other government bodies (e.g., health authority for food-related businesses).

Schedule an Appointment at the DED:

Book an appointment through the DED’s online portal or by visiting their office.

Attend the Appointment:

Go to the DED office on your scheduled date. Bring all required documents and your application forms.

Provide Business Information:

During your appointment, provide details about your business activities, address, and personal details. Ensure all information is accurate and complete.

Pay the Registration Fee:

Pay the registration fee, which varies depending on your business type and activities. Payment can be made on-site at the DED office.

Receive Your Trade License:

After successful registration, you will receive your trade license, allowing you to legally operate your business in Dubai.

Register for Taxes:

If applicable, register your business with the Federal Tax Authority (FTA) to fulfill your tax obligations, especially if your business exceeds the VAT threshold.

By following these steps, you can successfully register your company with the DED, ensuring compliance with Dubai’s business regulations and paving the way for your entrepreneurial journey in the UAE.

In Dubai, a Limited Liability Company (LLC) is one of the most popular business structures for foreign investors and entrepreneurs. The minimum share capital requirement for establishing a Dubai LLC has been set by the Department of Economic Development (DED) and is influenced by the nature of the business activity.

Minimum Share Capital Requirements

As of the latest regulations, the minimum share capital required to establish a Dubai LLC is AED 300,000 (approximately USD 81,600). This amount must be deposited in a UAE bank account and can be accessed once the company is registered. The share capital can be in cash or assets, depending on the business's nature and the partners' agreement.

Considerations for Share Capital

Reflecting Business Needs: While the minimum capital is AED 300,000, it's essential to determine a share capital that realistically reflects your business's operational needs. This consideration can help ensure financial stability and demonstrate your commitment to potential partners and investors.

Improving Creditworthiness: Having a share capital that exceeds the minimum requirement can enhance the company’s credibility with banks and suppliers. A robust financial foundation can improve your chances of obtaining loans or credit facilities, as financial institutions often consider share capital when assessing risk.

Enhancing Reputation: A higher share capital can positively affect your company's image in the marketplace. Clients and suppliers may perceive a company with substantial capital as more reliable and stable, fostering trust and facilitating better business relationships.

Facilitating Growth: For companies planning to expand or invest significantly, having a higher share capital allows for greater flexibility in operations. This can include hiring more employees, acquiring assets, or increasing production capacity without the need to seek additional funding immediately.

A Limited Liability Company (LLC) in Dubai has various tax obligations that must be adhered to in order to comply with local regulations. Understanding these obligations is essential for maintaining legal compliance and ensuring smooth business operations.

Corporate Tax

As of June 2023, the UAE introduced a federal corporate tax for the first time. LLCs are subject to a corporate tax rate of 9% on taxable income exceeding AED 375,000 (approximately USD 102,000). This tax is designed to align with international standards and promote a competitive business environment. Income below this threshold is tax-exempt, encouraging small businesses and startups to thrive.

Value Added Tax (VAT)

If your Dubai LLC engages in taxable goods and services, it must comply with Value Added Tax (VAT) regulations. The standard VAT rate in the UAE is 5%. Businesses are required to charge VAT on their sales and file regular VAT returns (usually quarterly) with the Federal Tax Authority (FTA). Accurate record-keeping of VAT collected and paid is crucial for compliance and for reclaiming any overpaid VAT.

Withholding Tax

The UAE does not impose withholding tax on outbound dividends, interest, or royalties, making it a favorable location for foreign investments. However, businesses should ensure compliance with international agreements and local laws to avoid any potential tax liabilities.

Payroll Taxes

Although the UAE does not levy personal income tax on employees, companies must comply with social security contributions for UAE national employees. Employers are required to contribute 12.5% of the employee's salary to the General Pension and Social Security Authority (GPSSA) for UAE nationals. This obligation does not apply to expatriate employees.

Economic Substance Regulations (ESR)

Certain business activities conducted in Dubai are subject to Economic Substance Regulations, which require companies to demonstrate substantial economic activity in the UAE. Companies engaged in relevant activities must file an Economic Substance Notification and an Economic Substance Report annually, ensuring compliance with local regulations.

Record-Keeping and Accounting

Maintaining accurate financial records is essential for a Dubai LLC to comply with tax obligations. This includes keeping detailed accounts of all income, expenses, VAT collected and paid, and employee payroll. Companies should consider regular audits to ensure compliance with UAE tax regulations and to maintain a clear financial status.

Free Zone Considerations

If an LLC operates within a free zone, it may benefit from specific tax exemptions and incentives, such as 100% foreign ownership and no corporate tax for a set period (often 15-50 years). However, businesses must adhere to the regulations set by the specific free zone authority.

Operating a company in Dubai involves several ongoing compliance requirements to maintain legal standing and ensure operational integrity. These requirements encompass financial reporting, regulatory compliance, and corporate governance, which are crucial for fostering stakeholder trust and adhering to UAE laws.

Financial Reporting

Annual Financial Statements: Companies in Dubai are required to prepare annual financial statements that reflect their financial position and performance. These statements must comply with the International Financial Reporting Standards (IFRS) or the UAE Generally Accepted Accounting Principles (UAE GAAP).

Audit Requirements: Depending on the company’s size and activities, an audit may be mandatory. Most companies operating in free zones or mainland Dubai are required to have their financial statements audited by a registered audit firm. The audited financial statements must typically be submitted to relevant authorities, including the Department of Economic Development (DED) or free zone authorities.

Tax Compliance

Corporate Tax: As of June 2023, LLCs in Dubai must file annual corporate tax returns. The corporate tax is levied on taxable income exceeding AED 375,000 at a rate of 9%. Compliance includes accurate reporting of income and expenses to avoid penalties.

Value Added Tax (VAT): If applicable, companies must charge VAT on taxable sales and file VAT returns with the Federal Tax Authority (FTA) regularly. The standard VAT rate in the UAE is 5%, and businesses must maintain detailed records of VAT collected and paid.

Employment and Payroll Compliance

Labor Law Compliance: Companies must comply with UAE labor laws, including proper documentation for employee contracts and maintaining records of labor relations. This includes adhering to the provisions of the UAE Labor Law regarding working hours, overtime, and termination of employment.

Social Security Contributions: For UAE national employees, companies must make social security contributions to the General Pension and Social Security Authority (GPSSA).

Licensing and Regulatory Compliance

Business Licenses: Companies must renew their business licenses annually. This includes ensuring that all activities listed in the trade license are being conducted and that any changes to the business structure or ownership are reported to the DED or relevant free zone authority.

Economic Substance Regulations: Businesses engaged in relevant activities are required to comply with Economic Substance Regulations (ESR), which may include submitting annual notifications and reports to demonstrate economic activity in the UAE.

Corporate Governance and Record Keeping

Shareholder and Director Records: Companies must maintain up-to-date records of shareholders and directors, including any changes in ownership or management.

Annual General Meetings (AGMs): While not legally required for all business structures in the UAE, holding AGMs can be beneficial for transparency and decision-making. Companies should keep minutes of meetings and significant decisions for their records.

Compliance with Anti-Money Laundering (AML) Regulations

Companies must adhere to the UAE’s Anti-Money Laundering (AML) regulations, which require them to implement measures to prevent money laundering and to report any suspicious activities to the relevant authorities.

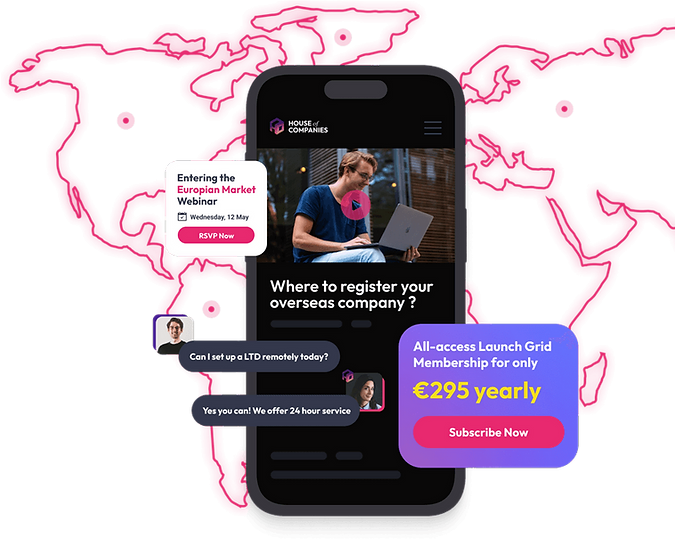

With a combined twelve years of expertise, the House of Companies team has been helping entrepreneurs launch their businesses in Dubai.

Did you know that a branch can be registered in as little as one day?

In Dubai, you do not need a notary to register a branch office. This simplifies the process for international businesses looking to establish a presence in the UAE.

Anyone starting a business in Dubai using our Entity Portal can rest assured that they will be able to open a local bank account seamlessly.

Forming a local company, such as a Limited Liability Company (LLC), is becoming less favored compared to registering a branch in Dubai. House of Companies is a pioneer in empowering entrepreneurs worldwide, making it easier for you to establish your Dubai business with reduced reliance on expensive advisors and notaries.

How about we discuss your choices?

Absolutely! One of the advantages of Dubai is that you don't need to be a resident to start a business there. You can establish a company in Dubai as long as you have a legitimate business address in the emirate and meet all the legal requirements. This includes having a local sponsor or partner (if you're setting up in the mainland) and registering your business with the Department of Economic Development (DED).

While the process might seem daunting at first, the right guidance and support can help you navigate it smoothly. Dubai's vibrant economy, strategic location, and business-friendly environment attract entrepreneurs from around the globe.

So, don’t let your non-resident status hold you back—take advantage of the opportunities available and turn your business aspirations into reality in Dubai!

How about we discuss your choices?

An efficient alternative to establishing a full-fledged company in Dubai is to set up a representative office to manage your interests in the region.

A representative office can serve as an intermediary between your existing business and potential partners or clients in Dubai. It facilitates networking, market research, and opens up avenues for new business opportunities. Although a representative office cannot engage in profit-generating activities, it provides a secure entry point into the Dubai market.

Once your representative office is poised for expansion, it can be converted into a fully operational branch. This transformation will enable your business to register for VAT, act as an Employer of Record, and unlock a host of additional capabilities in the dynamic Dubai marketplace.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!