Excellent accounting services are provided by our new Dubai office to companies operating in the region. Our particular areas of expertise for businesses in Dubai include tax filing and financial reporting.

Our local experience generates accurate, fast, Dubai-compliant financial reporting. We file taxes for you, alleviating concerns about local tax laws. We take care of compliance and financial reporting, allowing you to expand your business seamlessly.

Local and international businesses operating in Dubai receive tailored client service. Our industry knowledge and personal touch ensure the best service available for every client. Trust our experts in financial management to give you the freedom to concentrate on your corporate objectives.

Automated OSS filing for import traders and e-commerce.

Close your fiscal year and generate financial statements with a click!

Ready to expand into Dubai and beyond? Run and build your business!

Ready to branch out to the Dubai and beyond? Manage your entity and your growth!

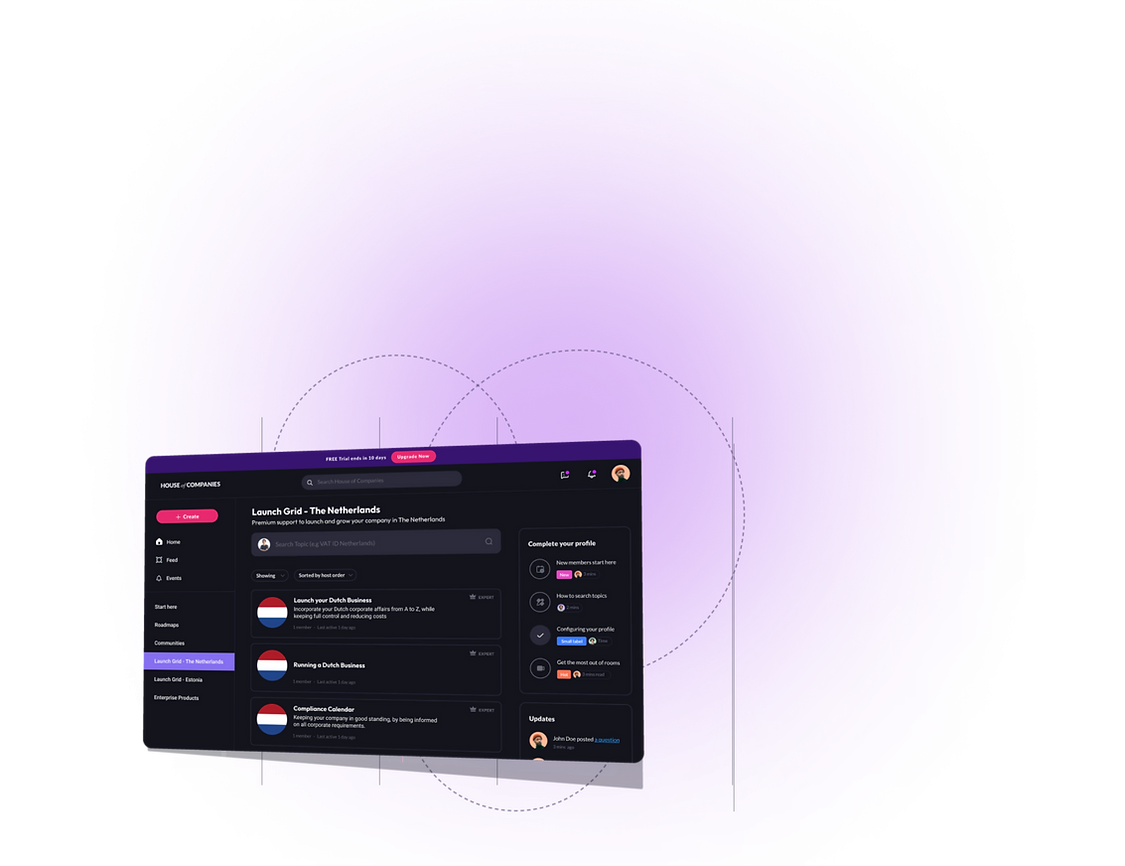

Delivering and processing invoices, bank statements, and agreements (such as your lease) is becoming increasingly straightforward in Dubai. House of Companies simplifies the submission of your data by providing a single source for all documents, data, and reports.

With our system, you can monitor progress and track your profits in real time, ensuring that your business remains financially agile and responsive to the fast-paced Dubai market.

Dubai's accounting regulations are designed to promote transparency and accountability within businesses, making it essential for companies operating in the emirate to understand and comply with these standards. The accounting framework in Dubai is governed by several key regulations and guidelines, including the International Financial Reporting Standards (IFRS) and local requirements set forth by regulatory authorities.

Key aspects of Dubai's accounting regulations include the requirement for companies to maintain accurate and up-to-date financial records, prepare annual financial statements, and submit them to relevant authorities such as the Dubai Economic Department (DED) and the Federal Tax Authority (FTA). These statements must comply with the legal format outlined in the UAE Commercial Companies Law, ensuring they provide a true and fair view of the company's financial position.

For businesses operating in Dubai, our entity management services offer comprehensive support in adhering to these regulations. We assist with bookkeeping, preparation of financial statements, and compliance reporting, ensuring that our clients meet their obligations efficiently and accurately. Our expertise in Dubai's accounting practices allows companies to focus on their core operations while we handle the complexities of financial compliance.

Understanding the tax implications for companies in Dubai requires a nuanced approach, especially when considering the distinction between substance and non-substance entities. In Dubai, companies benefit from a favorable tax environment, with no corporate or income taxes for most businesses. However, to maintain these benefits, companies must demonstrate economic substance by proving they are genuinely conducting business activities within the region. This involves meeting specific criteria, such as having a physical office, employing qualified staff, and incurring operational expenditures in Dubai.

For companies classified as non-substance, the tax landscape can be more complex. These entities might face scrutiny under international tax regulations, such as the OECD's Base Erosion and Profit Shifting (BEPS) initiatives, which aim to prevent tax avoidance strategies that exploit gaps and mismatches in tax rules. Non-substance companies may need to provide additional documentation and justifications to tax authorities to prove their legitimacy and avoid potential penalties or loss of tax benefits.

Understanding these tax implications requires strategic planning and a thorough understanding of both local and international tax laws. Companies in Dubai should regularly review their operations to ensure compliance with substance requirements, thereby safeguarding their tax advantages. Engaging with local tax advisors can provide valuable insights and help businesses align their practices with regulatory expectations, ensuring long-term sustainability and growth in Dubai's dynamic business environment.

Setting Up a Business in Dubai: Options for Non-Residents

Dubai offers a dynamic and business-friendly environment, making it an attractive destination for entrepreneurs worldwide. Non-residents looking to establish a business in Dubai have several legal entity options to consider. The most common types include Free Zone Companies, Mainland Companies, and Offshore Companies. Each type offers unique benefits and requirements tailored to different business needs and objectives.

Free Zone Companies

Free Zone Companies are popular among non-residents due to their 100% foreign ownership allowance and tax exemptions. These zones are strategically located across Dubai, offering state-of-the-art infrastructure and business facilities. Free Zones cater to specific industries, providing a supportive ecosystem for businesses to thrive. However, companies established in Free Zones are generally restricted from conducting business directly with the UAE market unless they partner with a local distributor.

Mainland and Offshore Companies

Mainland Companies allow businesses to operate within the local UAE market without restrictions. However, they require a local sponsor or partner holding at least 51% of the shares. This setup is ideal for businesses targeting the local market. Offshore Companies, on the other hand, are primarily used for international business operations. They offer confidentiality and minimal reporting requirements but cannot conduct business within the UAE. Choosing the right entity depends on your business goals, target market, and operational needs.

When registering a branch office in Dubai, there are several accounting considerations to keep in mind to ensure compliance and efficient operations. Firstly, it's essential to understand the local regulatory environment. Dubai operates under a unique set of commercial laws and regulations, which require branch offices to maintain accurate financial records and submit annual audits. This means engaging with a local accounting firm familiar with UAE laws can be beneficial to navigate these requirements and avoid any legal pitfalls.

Secondly, tax implications are a crucial factor. While Dubai is known for its tax-friendly environment, branch offices must still adhere to specific tax regulations, such as VAT compliance. Understanding the nuances of VAT registration and filing is vital, as non-compliance can lead to penalties. Additionally, branches must consider transfer pricing rules if they engage in transactions with their parent company, ensuring that all inter-company transactions are conducted at arm's length.

Lastly, financial reporting and currency considerations play a significant role. Branch offices need to prepare financial statements in accordance with International Financial Reporting Standards (IFRS), which are widely adopted in the UAE. Moreover, with the UAE dirham pegged to the US dollar, companies must be aware of currency exchange implications, especially if their parent company operates in a different currency. Proper financial planning and currency risk management strategies can help mitigate potential financial losses due to currency fluctuations.

Dubai's tax registration requirements are designed to facilitate business operations while ensuring compliance with local regulations. Companies operating in Dubai must register for Value Added Tax (VAT) if their taxable supplies and imports exceed the mandatory registration threshold of AED 375,000. This registration is crucial for businesses to legally collect VAT on behalf of the government and to claim any VAT refunds on business-related purchases. The process involves submitting an online application through the Federal Tax Authority's (FTA) portal, providing necessary documentation such as trade licenses and financial records.

Once registered, businesses are required to adhere to specific compliance obligations, including filing regular VAT returns and maintaining accurate financial records. VAT returns must be filed quarterly or monthly, depending on the business's annual turnover, and must detail all taxable supplies, imports, and exports. Failure to comply with these requirements can result in penalties, making it essential for businesses to stay informed and up-to-date with any changes in tax regulations.

In addition to VAT, businesses in Dubai may also need to consider other tax-related obligations depending on their structure and activities. For example, companies operating in free zones might benefit from tax exemptions, but they still need to comply with VAT regulations if they conduct business with the mainland. Engaging with a local tax advisor can help businesses navigate the complexities of Dubai's tax landscape, ensuring they meet all registration and compliance requirements efficiently.

Dubai's VAT compliance framework is designed to ensure that businesses operate within a structured tax environment, promoting transparency and accountability. Businesses in Dubai are required to register for VAT if their taxable supplies and imports exceed the mandatory registration threshold of AED 375,000. This registration process involves submitting necessary documents and information to the Federal Tax Authority (FTA), ensuring that businesses are recognized as VAT-compliant entities. Once registered, businesses must charge VAT on taxable goods and services, maintain accurate records, and file periodic VAT returns to the FTA.

For businesses, understanding the intricacies of VAT compliance is crucial to avoid penalties and ensure smooth operations. This involves not only charging VAT but also reclaiming any VAT paid on business-related expenses. Companies must keep detailed records of all transactions, including invoices and receipts, to support their VAT filings. Additionally, businesses should stay informed about any changes in VAT regulations to ensure ongoing compliance. This proactive approach helps in mitigating risks associated with non-compliance and enhances the company's reputation in the market.

Moreover, VAT compliance in Dubai offers opportunities for businesses to streamline their financial processes and improve cash flow management. By integrating VAT considerations into their financial planning, businesses can optimize their pricing strategies and enhance profitability. Engaging with tax professionals or consultants can provide valuable insights and assistance in navigating the complexities of VAT regulations. This strategic approach not only ensures compliance but also positions businesses for sustainable growth in Dubai's dynamic economic landscape.

Registering as an employer in Dubai is a crucial step for businesses that plan to hire staff and manage payroll. This process involves obtaining a labor establishment card from the Ministry of Human Resources and Emiratisation (MOHRE) and registering with the General Pension and Social Security Authority (GPSSA) if applicable. Employers must also ensure compliance with the UAE's labor laws, which include providing employment contracts, adhering to wage protection systems, and ensuring timely payment of salaries. Proper registration not only legitimizes the business operations but also protects the rights of both the employer and employees under the UAE labor regulations.

Once registered, employers are responsible for maintaining accurate payroll records, which include details of employee salaries, benefits, and deductions. This involves setting up a payroll system that complies with local regulations, including the Wage Protection System (WPS), which mandates electronic salary transfers through approved financial institutions. Employers must also stay updated on any changes in labor laws and regulations to ensure ongoing compliance. By effectively managing payroll and adhering to legal requirements, businesses can foster a positive work environment and enhance their reputation as fair and responsible employers in Dubai.

Resident companies in Dubai are subject to corporate income tax (CIT) on their profits. As part of the UAE's efforts to enhance its fiscal framework, a federal corporate tax of 9% on taxable income exceeding AED 375,000 will be effective starting June 1, 2023. This tax rate is designed to maintain the UAE's attractiveness as a global business hub while ensuring that corporate contributions to the economy are fair and sustainable.

Key Aspects of Corporate Income Tax in Dubai:

Tax Returns: All companies, including free zone entities, must file annual corporate income tax returns, detailing their taxable income. The filing must be done within nine months after the end of the financial year.

Advance Payments: Companies are required to make advance tax payments throughout the year based on estimated taxable income. These payments help avoid penalties and interest charges for late submissions.

Non-Resident Companies: Non-resident entities are liable for CIT only on their UAE-source income, including profits attributable to a permanent establishment in Dubai. They must also file corporate income tax returns and pay taxes on their taxable income derived from UAE operations.

Compliance and Deductions: Businesses should stay informed about their tax obligations, deadlines, and any potential deductions available under UAE law. Understanding these aspects is critical for avoiding penalties and maintaining good standing with the UAE tax authorities.

To ensure compliance with Dubai's tax regulations, it is advisable for companies to seek professional advice from tax consultants or legal experts familiar with the UAE tax system. At House of Companies, we provide expert guidance to help you navigate these regulations, ensuring your business remains compliant while maximizing tax efficiency.

Bookkeeping is a crucial aspect of financial management for businesses operating in Dubai. It involves the systematic recording of all financial transactions, ensuring that income and expenses are accurately tracked. Maintaining precise bookkeeping is not only essential for compliance with local regulations but also vital for effective decision-making and financial planning. Our team at House of Companies provides comprehensive bookkeeping services tailored to your business needs, ensuring that your financial records are up-to-date and reflective of your operations.

Financial reporting is the next critical step that follows accurate bookkeeping. In Dubai, companies are required to prepare and submit annual financial statements in accordance with International Financial Reporting Standards (IFRS) and local regulations. These statements provide stakeholders with a clear view of the company's financial health and performance. Our experts assist in preparing these financial reports, ensuring they comply with legal requirements while offering insights that can drive strategic decisions. With our support, you can focus on growing your business while we handle the complexities of bookkeeping and financial reporting.

In Dubai, consolidation standards for businesses are primarily governed by the International Financial Reporting Standards (IFRS), specifically IFRS 10, which outlines the requirements for consolidated financial statements. Companies that control one or more subsidiaries are required to present consolidated financial statements that provide a comprehensive view of their financial position and performance as a single economic entity. This includes the total assets, liabilities, equity, revenue, and expenses of both the parent company and its subsidiaries, allowing stakeholders to assess the overall health and operational efficiency of the group.

Compliance with these consolidation standards is essential for companies operating in Dubai, as it enhances transparency and accountability in financial reporting. Companies must ensure that all subsidiaries are accurately accounted for, eliminating any intra-group transactions and balances to avoid double counting. Adhering to these standards not only fulfills regulatory requirements but also improves investor confidence and aids in effective decision-making for management and stakeholders alike. To navigate the complexities of consolidation, businesses often seek the expertise of accounting professionals who can ensure compliance with the applicable IFRS guidelines.

In Dubai, medium and large companies, as well as those adhering to International Financial Reporting Standards (IFRS), are required by law to have their annual financial statements audited by an independent, qualified, and registered auditor. The auditor’s report must verify that the financial statements comply with the accounting standards set by the UAE Ministry of Finance and accurately reflect the company’s financial position and performance for the fiscal year. This ensures transparency and accountability in financial reporting, aligning with Dubai's commitment to maintaining a robust business environment.

House of Companies supports its clients in navigating these regulatory requirements by providing expert guidance and resources to ensure compliance with Dubai's auditing standards. Our team of professionals assists in preparing accurate financial statements and liaises with registered auditors to facilitate a seamless audit process. We ensure that our clients' financial reports meet all necessary legal criteria, thereby enhancing their credibility and trustworthiness in the market.

By leveraging our expertise in Dubai's regulatory landscape, House of Companies empowers businesses to focus on growth and expansion while we handle the complexities of financial compliance. Our comprehensive services include real-time monitoring and updates on regulatory changes, ensuring that our clients remain compliant and informed. This proactive approach not only mitigates risks but also positions our clients for success in Dubai's dynamic economic environment.

In Dubai, the audit requirements for entity management are governed by the UAE Commercial Companies Law and the regulations set forth by the Dubai Economic Department (DED). All companies, including free zone entities, are required to have their financial statements audited annually by a licensed external auditor. This audit aims to ensure compliance with local accounting standards and regulations, providing assurance that the financial statements present a true and fair view of the company's financial position. Companies must submit their audited financial statements along with their corporate tax returns to the Federal Tax Authority (FTA), reinforcing the importance of transparency and accountability in financial reporting. Engaging a reputable auditing firm not only fulfills regulatory obligations but also enhances credibility with stakeholders and facilitates better business decision-making.

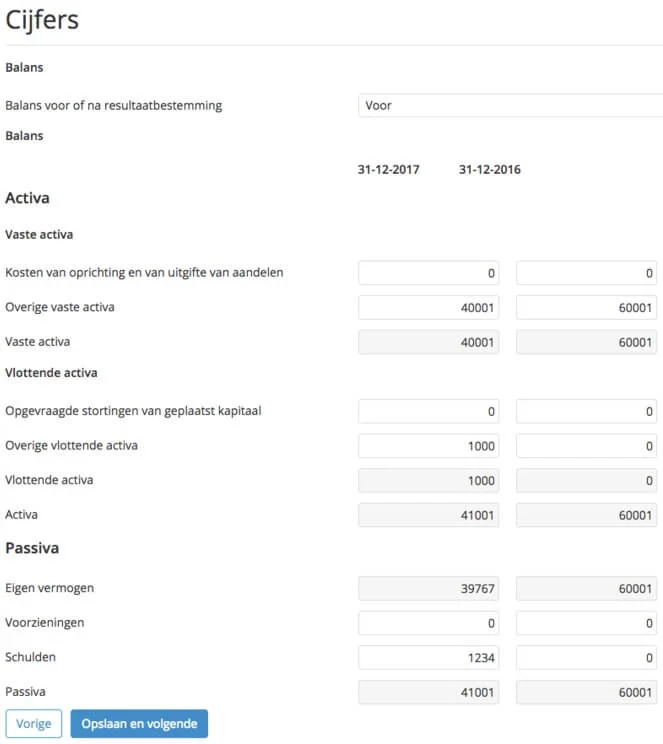

Under Dubai law, corporate entities are required to prepare financial statements in accordance with the applicable accounting standards, primarily the International Financial Reporting Standards (IFRS). These financial statements are essential for ensuring transparency and accountability within the corporate governance framework and play a significant role in taxation, serving as the basis for determining taxable income, although tax regulations may have specific rules of their own.

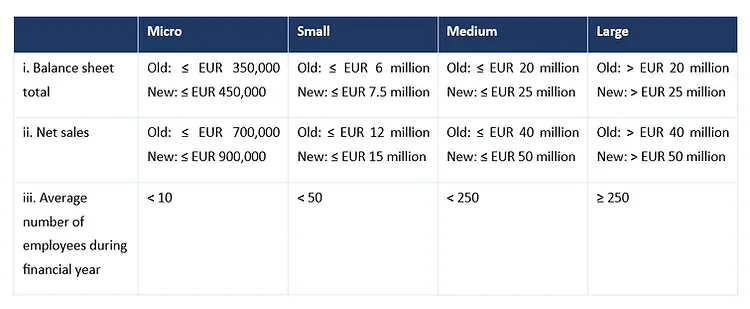

The content of financial statements in Dubai varies based on the company’s size and regulatory requirements but generally must include at least a balance sheet, an income statement, and explanatory notes. These statements should accurately reflect the company's financial position, and any changes in accounting policies or estimates must be disclosed in the notes. Additionally, parent companies are typically required to consolidate the financial data of controlled subsidiaries and other group companies in their consolidated financial statements. However, consolidation may be omitted under certain conditions, such as when a subsidiary qualifies as a small entity under UAE regulations or when the financial information has already been included in the parent company's consolidated statements prepared in accordance with applicable accounting standards.

Online bookkeeping services have become essential for businesses in Dubai looking to streamline their financial operations. These services offer a comprehensive range of features tailored to meet the specific needs of both startups and larger enterprises. By leveraging advanced technology and professional expertise, online bookkeeping providers deliver accurate financial reports and efficiently manage financial data, helping businesses maintain compliance with local regulations and make informed decisions. With the dynamic business environment in Dubai, these services not only enhance operational efficiency but also provide real-time insights, enabling companies to focus on their core activities while ensuring robust financial management.

Online bookkeeping services in Dubai offer businesses the convenience and expertise needed to manage their financial records efficiently. With the stringent regulations set by the Dubai government, including compliance with the Federal Tax Authority (FTA) and adherence to the UAE's VAT laws, businesses require precise and accurate bookkeeping. Our services ensure that all financial transactions are recorded in compliance with local regulations, helping businesses avoid penalties and maintain transparency. By leveraging advanced technology and a team of experienced professionals, we provide real-time access to financial data, enabling businesses to make informed decisions swiftly.

Our expertise extends beyond basic bookkeeping; we offer comprehensive support tailored to the unique needs of businesses operating in Dubai. This includes managing payroll in accordance with the Wage Protection System (WPS), preparing financial statements, and ensuring VAT compliance. Our team stays updated with the latest changes in local regulations, providing clients with peace of mind knowing their financial records are in expert hands. We understand the complexities of operating in Dubai's dynamic business environment and are committed to delivering services that enhance operational efficiency and financial accuracy.

Partnering with us for your online bookkeeping needs means having expertise at your fingertips. We utilize cutting-edge software to streamline bookkeeping processes, reduce errors, and improve efficiency. Our user-friendly platform allows clients to easily access and review their financial data anytime, anywhere. By choosing our services, businesses in Dubai can focus on growth and expansion, confident that their financial compliance and bookkeeping needs are expertly managed. Our commitment to excellence and client satisfaction makes us a trusted partner for businesses seeking reliable online bookkeeping services in Dubai.

Virtual bookkeeping services pricing in Dubai can vary significantly depending on the pricing model chosen by the business. Understanding these models is essential for companies to make informed decisions regarding their financial management. Common pricing structures include:

Hourly Rates: This traditional model charges clients for the time spent on their bookkeeping tasks. It's often suitable for businesses that require occasional bookkeeping assistance and prefer flexibility in managing their financial records.

Monthly Subscription Fees: This model offers clients predictable monthly expenses for their bookkeeping needs, providing a consistent budget for financial management. It aligns well with businesses seeking regular and ongoing support to ensure compliance with Dubai's financial regulations.

Project-Based Pricing: Under this structure, clients are charged based on specific bookkeeping tasks or projects, allowing for flexibility depending on the nature and complexity of the work. This model is ideal for businesses that require specialized services, such as VAT compliance or financial audits, which are crucial under Dubai's regulatory framework.

Value-Based Pricing: This approach focuses on the perceived value of the services provided rather than the time or resources expended. It is designed to reflect the benefits and outcomes that clients can expect from the bookkeeping services, particularly in optimizing financial operations and ensuring adherence to local government regulations.

Factors Influencing Pricing: Several factors can influence pricing in Dubai, including the scope of services, the geographic location of the service provider, and the level of customization required for the client's specific needs. Additionally, Dubai's regulatory requirements, such as VAT registration and compliance, can impact the complexity and cost of bookkeeping services.

Businesses should also be aware of potential hidden costs, such as additional fees for specific services or changes in service scope. It's advisable to seek out providers that offer scalability in their pricing plans, allowing for adjustments as the business grows or its needs change. At House of Companies, we support our clients by offering tailored bookkeeping solutions that ensure compliance with Dubai's financial regulations, providing peace of mind and empowering businesses to focus on growth.

Our online bookkeeping services in Dubai are meticulously crafted to meet the needs of businesses operating in this vibrant market. With an in-depth understanding of local regulations and financial practices, we offer comprehensive solutions that streamline financial management and boost operational efficiency.

Key Features:

Local Compliance: Our services ensure adherence to Dubai's accounting standards and tax regulations, as mandated by the UAE Federal Tax Authority and the Dubai Department of Economic Development. This helps businesses avoid penalties and maintain compliance effortlessly.

Real-Time Access: Businesses can access their financial data anytime, anywhere, through our secure online platform. This feature enables informed decision-making and strategic planning, crucial for thriving in Dubai's fast-paced business environment.

Tailored Reporting: We provide customized financial reports that cater to the unique needs of each business, offering valuable insights into performance and growth opportunities. This personalized approach helps businesses in Dubai stay competitive and agile.

Expert Support: Our team of local bookkeeping professionals is available to offer guidance and assistance, ensuring that businesses receive the support they need to succeed in Dubai's competitive landscape. Our experts are well-versed in local regulations and practices, providing peace of mind to our clients.

Integration Capabilities: Our services seamlessly integrate with popular accounting software, facilitating easy financial management while maintaining existing workflows. This integration ensures that businesses can efficiently manage their finances without disrupting their operations.

By choosing our online bookkeeping services, businesses in Dubai can enhance their financial operations, focus on growth, and achieve their objectives with confidence. Our commitment to local compliance, real-time access, and expert support makes us the ideal partner for businesses aiming to excel in Dubai's dynamic market.

Industry-specific bookkeepers in Dubai bring a wealth of knowledge that extends beyond basic accounting principles. They possess an in-depth understanding of sector-specific regulations, tax implications, and financial best practices, enabling them to:

Protect organizations' financial policies: Our bookkeepers ensure that your financial policies align with Dubai's regulatory framework, safeguarding your business against potential legal issues.

Ensure compliance with industry-specific Dubai guidelines: By staying updated with the latest regulations from local government agencies such as the Dubai Department of Economic Development (DED) and the Federal Tax Authority (FTA), our experts ensure your business remains compliant.

Quickly identify and rectify errors: With their keen eye for detail, our bookkeepers can swiftly detect and correct any discrepancies, maintaining the integrity of your financial records.

Maintain a strong awareness of the commercial landscape: Our team is well-versed in Dubai's dynamic business environment, providing insights that help you stay ahead of market trends.

Their expertise allows them to work effectively with a variety of stakeholders, from clients to senior management, making them highly capable of managing complex relationships within Dubai's business ecosystem. At House of Companies, we support our clients by offering tailored bookkeeping services that enhance operational efficiency and ensure compliance with local regulations.

Value-based Pricing in Dubai

In Dubai, value-based pricing ensures that charges are determined by the perceived value of services rather than the time spent. This approach guarantees that businesses receive tailored solutions that align with the importance of the service provided. By focusing on the value delivered, companies in Dubai can access services that are specifically designed to meet their strategic goals and operational needs, ensuring a high return on investment.

Tiered Packages and Customized Pricing

Our services in Dubai offer tiered packages, including basic, standard, and premium options, to accommodate different business needs and budgets. Additionally, we provide customized pricing models that are specifically adapted to meet the unique requirements of various industries and client needs. This flexible pricing approach allows businesses in Dubai to access high-quality services that align with their financial constraints and specific industry demands, ensuring they receive the best possible support.

Industry-specific Bookkeeping Features in Dubai

Industry-specific bookkeepers in Dubai offer a range of features tailored to meet the unique challenges of various sectors, adhering to local regulations and standards. These include:

Integration with Industry-standard Technologies: Ensuring compatibility with Dubai's technological landscape.

These features enable businesses in Dubai to benefit from improved operational efficiency, enhanced compliance with local regulations, more accurate financial forecasting, and better-informed decision-making processes. By leveraging AI-based accounting software, cloud computing, and automation, industry-specific bookkeepers in Dubai can significantly enhance productivity and reduce operational costs for their clients.

Virtual bookkeeping assistants have become an essential asset for businesses in Dubai looking to streamline their financial management processes. These skilled professionals offer remote support, efficiently managing financial records, transactions, and reporting in compliance with Dubai's financial regulations. By utilizing advanced accounting software and tools, virtual bookkeeping assistants in Dubai handle various tasks, including data entry, reconciliations, payroll processing, and expense tracking with precision. Their expertise helps businesses maintain accurate financial records while saving time and resources, making them a valuable solution for both small enterprises and larger companies in the Dubai market.

In Dubai, businesses must adhere to specific regulations set by local government agencies such as the Dubai Financial Services Authority (DFSA) and the Department of Economic Development (DED). Virtual bookkeeping assistants ensure compliance with these regulations by staying updated on the latest legal requirements and implementing best practices in financial management. They assist in preparing VAT returns, maintaining audit-ready records, and ensuring that all financial activities align with the UAE's legal framework. This compliance not only helps businesses avoid penalties but also enhances their credibility in the market.

At House of Companies, we support our clients in Dubai by providing experienced virtual bookkeeping assistants who understand the local regulatory landscape. Our team is equipped to handle the unique financial challenges faced by businesses in Dubai, offering personalized solutions that align with each client's specific needs. By leveraging our expertise, clients can focus on their core business activities while we manage their financial processes with accuracy and efficiency. Our commitment to excellence ensures that businesses in Dubai can achieve their financial goals while remaining compliant with local regulations.

Virtual bookkeeping assistants in Dubai offer extensive knowledge and expertise in financial management, tailored to the unique regulatory environment of the UAE. They possess a deep understanding of Dubai's accounting principles and are proficient in using various cloud-based accounting platforms. These professionals manage a wide range of tasks, including maintaining balance sheets, preparing income statements, optimizing financial resources, and generating customized reports. Their ability to collaborate effectively with diverse stakeholders, from clients to senior management, makes them well-suited to navigate the complex business landscape in Dubai.

Many virtual bookkeeping assistants in Dubai have significant industry experience, with some professionals having worked for over a decade. They regularly undergo training to stay updated on the latest UAE accounting standards, tax regulations, and reporting requirements set by local government agencies such as the Dubai Financial Services Authority (DFSA) and the Federal Tax Authority (FTA). This ensures that businesses receive accurate, compliant, and up-to-date financial services specifically tailored to the Dubai market.

At House of Companies, we support our clients by providing expert virtual bookkeeping services that align with Dubai's regulatory requirements. Our team ensures compliance with local laws and offers strategic insights to enhance financial performance. By leveraging our expertise, businesses can focus on growth while we handle their financial management needs, ensuring accuracy and efficiency in all financial processes.

Hiring a virtual bookkeeping assistant in Dubai can vary in cost based on several factors, including the assistant's experience, expertise, and the complexity of the tasks involved. Pricing models often include hourly rates, fixed monthly retainers, or project-based fees. In Dubai, hourly rates for virtual bookkeeping assistants can range from AED 20 to over AED 275. Businesses seeking consistent support often opt for monthly subscription plans, which are structured in tiers to suit different requirements and budgets. These plans offer flat rates for a set number of hours per week or month, providing a predictable cost structure.

For businesses in Dubai, virtual bookkeeping services are essential for maintaining compliance with local regulations set by government agencies such as the Federal Tax Authority (FTA). Our services include transaction recording and reconciliation, accounts payable and receivable management, and bank statement reconciliation. We also handle the preparation of financial statements, payroll processing, and tax compliance, ensuring that businesses adhere to UAE tax laws. Our expertise in integrating with popular accounting software and providing real-time financial reporting and analytics helps businesses make informed strategic decisions.

Our virtual bookkeeping assistants offer a comprehensive range of services to support businesses in Dubai, including custom report generation and multi-currency support for international operations. By leveraging our services, businesses can maintain accurate financial records and ensure compliance with local tax laws. Our team is dedicated to providing personalized support, helping clients navigate the complexities of Dubai's financial regulations and optimize their financial processes for growth and efficiency.

Hiring a virtual bookkeeping assistant in Dubai involves understanding the local regulations and leveraging the support of government agencies like the Dubai Department of Economic Development (DED) and the Federal Tax Authority (FTA). Pricing models for virtual bookkeeping services in Dubai often include hourly rates, fixed monthly retainers, or project-based fees. Hourly rates can vary widely, typically ranging from AED 20 to over AED 300, depending on the assistant's experience, expertise, and the complexity of the tasks involved.

For businesses seeking consistent support, many virtual bookkeeping services in Dubai offer monthly subscription plans. These plans are structured in tiers, allowing companies to choose the level of service that best fits their needs and budget. Some providers offer flat rates for a set number of hours per week or month, providing a predictable cost structure. It's important to note that pricing can also be influenced by the location of the virtual assistant, with those based in countries with a lower cost of living often charging lower rates than those based in Dubai, without compromising on quality.

Virtual bookkeeping assistants in Dubai offer a comprehensive range of services to support businesses, including:

These services help Dubai-based businesses maintain accurate financial records and ensure compliance with local tax laws, while also providing insights for strategic decision-making. At House of Companies, we empower our clients by offering tailored bookkeeping solutions that align with Dubai's regulatory requirements, ensuring efficiency and compliance.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!