Our services are tailored to meet your business needs on a global scale. We excel in managing corporate structures, compliance, and administrative tasks across various jurisdictions. With our in-depth knowledge of international regulations and local practices, particularly in Dubai, we streamline your global operations with ease.

For businesses aiming to establish themselves in Dubai, our entity management services offer comprehensive support. From the initial setup to ongoing compliance, we take care of every detail in the registration process. This service is integrated into our customer support, providing you with personalized guidance and expert advice every step of the way.

155,44

Companies launched

811

Branch Registration

15+

eBranch Options

10+ Playbooks

Support included

For SMEs entering the Dubai market, establishing a branch offers numerous advantages compared to setting up a limited liability company (LLC). One of the standout benefits is the exemption from dividend tax, allowing businesses to significantly reduce their tax expenses.

Moreover, there’s no requirement to file local financial statements, which minimizes administrative burdens and associated costs. A branch in Dubai also provides enhanced flexibility, enabling companies to maintain a closer connection with their parent organization while reaping the rewards of operating in this dynamic region. Embrace the opportunity to expand and thrive in Dubai’s vibrant market!

Registering a branch in Dubai offers a more streamlined approach compared to forming a local private company. Our Entity Management services simplify the entire process, eliminating the need for in-person notary meetings and cumbersome paperwork.

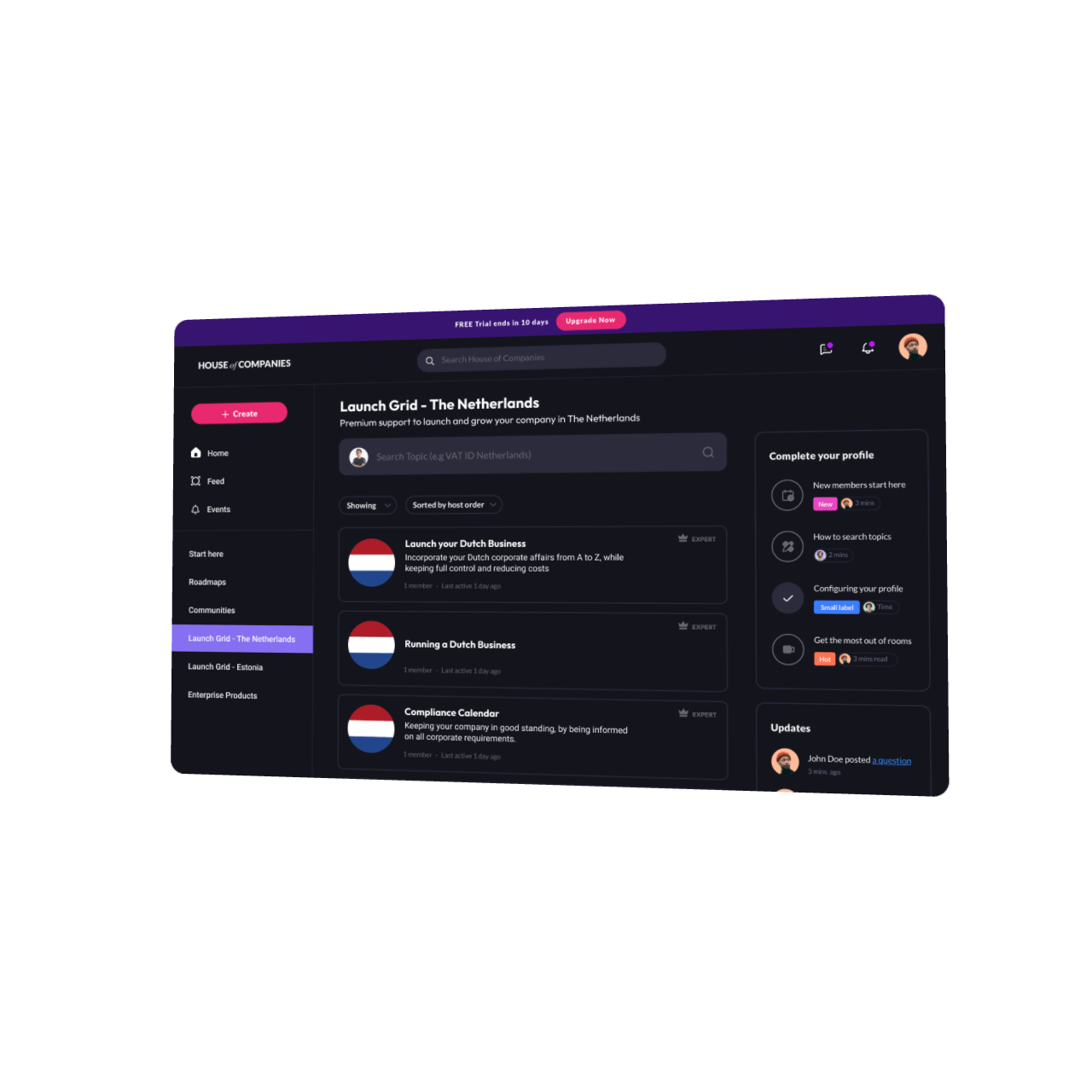

With our innovative Entity Portal, businesses can establish a branch in over 10 countries, including non-EU regions, quickly and affordably, without requiring extensive legal or accounting support. Enjoy the ease of expanding your operations with us in Dubai and beyond!

Our Entity Management services are tailored to streamline branch registration and provide continuous support for your business operations in Dubai.

From applying for a VAT ID to updating directorships and registering intellectual property like trademarks, our platform delivers a centralized, automated solution for all your corporate governance needs. We ensure seamless compliance with Dubai's accounting regulations, empowering you to focus on growing your business with confidence.

Unlock seamless banking for your business with a local Dubai IBAN number by opening a bank or EMI account through our expert services.

With our "no cure, no pay" policy, we take the financial risk out of the equation, guaranteeing success in securing your account. This way, you can focus on driving your business forward, knowing that your banking needs are in capable hands!

Managing your branch in Dubai has never been easier! Our Portal empowers you to effortlessly update your branch’s legal entity details and implement any necessary corporate changes.

If you decide to de-register your branch, enjoy a streamlined, hassle-free process with zero legal or notary fees. Experience simplicity and efficiency in your business journey in Dubai!

Registering your branch as a Representative Office in Dubai unlocks significant tax benefits, including exemptions from corporate tax filings and payments. For fully operational branches, standard corporate taxes apply, but you can enjoy the advantage of no withholding taxes on outgoing dividends, maximizing your financial benefits.

Our Entity Management services are expertly designed for global businesses, with Dubai as your strategic hub. From branch registration to comprehensive management and banking solutions, we deliver a complete package to help you establish your business and streamline operations worldwide. Experience the ease of "Registering Your Business" and effectively managing your global ventures with our tailored services.

Get more familiar with our support

Expanding a business internationally often requires establishing a branch in the new market. In Dubai, foreign companies must register a branch to create a permanent establishment and legally operate within the region. The branch registration process can feel overwhelming due to its intricate forms and documentation. Essential requirements typically include:

Additionally, businesses may need to secure a local business license, register with tax authorities, and comply with regional employment laws. Grasping the tax implications is vital, as the branch will be subject to Dubai’s tax regulations, making informed decisions crucial for smooth operations.

Registering a branch in Dubai presents a host of advantages over setting up a subsidiary, making it an attractive option for businesses aiming for a smooth market entry.

To start, the process of establishing a branch is typically simpler, quicker, and more cost-effective. Unlike a subsidiary, which involves a complex legal framework and adherence to extensive local regulations, a branch acts as an extension of the parent company. This significantly streamlines administrative procedures, resulting in reduced legal requirements and lower registration expenses.

Moreover, branches provide the parent company with direct financial and operational control, minimizing the necessity for separate local management. This arrangement enhances efficiency and oversight, allowing for more agile decision-making. Notably, a branch also avoids the additional taxation on dividends that often applies to subsidiaries, enabling more favorable financial outcomes.

Feel welcome, and try out our solutions. We can prepare a sample Annual Statement based on your current numbers, so you experience the simplicity of our portal!

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!