Get Free Demo to our Portal to Manage your Entity

or Start a Local Business.

Starting a business in Dubai unlocks a world of potential in a thriving, strategically located hub for trade and innovation. Whether you’re an entrepreneur from abroad or a UAE-based visionary, registering your business here is a seamless journey when guided by experienced professionals.

Navigating Dubai’s regulatory landscape can seem daunting, but that’s where we come in. Our dedicated team simplifies the entire process, supporting you from choosing the ideal business structure to meeting every regulatory requirement. We manage the details so that you can concentrate on expanding your business in one of the world’s most dynamic economies.

With Dubai’s tax advantages, a flourishing market environment, and exceptional access to global trade, now is the ideal time to secure your place in this vibrant ecosystem. Here’s a helpful overview of the main business entity types available in Dubai:

Launching a company in Dubai can be streamlined with the right guidance. Begin by selecting the best legal structure for your venture—whether it's a sole proprietorship, partnership, or an LLC (Limited Liability Company). Once decided, draft and notarize your articles of association, set up your initial capital, and complete your registration with Dubai’s official Trade Register. Additionally, ensure that you’re covered for VAT and tax registrations based on your business needs.

This process may seem complex, but our entity management services make it easy. From navigating essential requirements to handling documentation, we’re here to ensure your compliance with Dubai’s regulations, letting you concentrate on building a successful business. Partner with us for a smooth setup experience, where starting in Dubai becomes a confident and hassle-free step forward!

Establishing a company in Dubai is an exciting venture that involves a few essential steps, but with the right support, it can be a seamless experience. First, you need to select the ideal legal structure for your business—whether it’s a sole proprietorship, partnership, or a limited liability company (LLC). After determining the right structure, you’ll draft and notarize the articles of association, deposit your initial capital, and register with the relevant authorities.

Next, you'll need to complete the necessary tax and VAT registrations, depending on the nature of your business. While this might seem daunting, our expert entity management services are here to assist you every step of the way. We’ll guide you through each requirement, manage the paperwork, and ensure compliance with Dubai's regulations, allowing you to concentrate on launching your business successfully. Let us take the hassle out of your startup journey in Dubai!

Establishing your company correctly is vital for both legal and financial stability. Overlooking this crucial step can expose you to significant risks, including personal liability for business debts and the potential loss of personal assets. Choosing the right company structure significantly impacts your business's long-term success and growth. For example, incorporating as a Limited Liability Company (LLC) can protect your personal assets from any liabilities incurred by the business, offering you essential security.

On the other hand, if you choose to operate as a sole proprietorship, you may face unlimited personal liability, putting your personal assets at risk if the business encounters financial difficulties. Additionally, a well-defined legal structure enhances trust and credibility with clients and investors, strengthening your market position. Recognizing the importance of establishing your company correctly is fundamental to ensuring its longevity and sustainability.

TIP: In certain scenarios, a new company may not be necessary. For instance, if you are operating a foreign company that requires a VAT number in Dubai (for importing goods and paying VAT), you can apply directly for a VAT ID at the tax office without the need for local company registration.

When embarking on your entrepreneurial journey in Dubai, selecting the right company structure is one of the most critical decisions you’ll face. The legal framework you choose will influence various aspects of your venture, such as liability, taxation, and administrative obligations. Here’s an engaging overview of the most common business structures available in Dubai:

Sole Proprietorship: This straightforward model is perfect for freelancers and individual entrepreneurs. As a sole proprietor, you maintain complete control over your business; however, you also bear full personal liability for any debts or legal challenges that may arise.

Limited Liability Company (LLC): Popular among small to medium-sized enterprises, an LLC offers limited liability protection, safeguarding your personal assets against business debts. This structure requires at least one shareholder and provides more flexible management options compared to other types.

Public Joint Stock Company (PJSC): Ideal for larger businesses aiming to raise capital from the public, a PJSC can issue shares and operates under a more complex governance framework. Shareholders enjoy limited liability, protecting their personal assets.

Cooperative: This model is designed for businesses owned and operated by a collective of individuals. It’s particularly well-suited for collaborative ventures, allowing members to pool resources and share profits effectively.

Business Goals: Reflect on your long-term objectives and growth strategies, including any plans for attracting external investment.

Liability: Evaluate your risk tolerance and the extent of personal liability you are willing to assume.

Tax Implications: Different structures come with varied tax responsibilities. Consulting with a tax advisor can clarify the implications for your specific circumstances.

Administrative Burden: Assess the level of compliance and administrative tasks you are ready to manage as your business evolves.

Selecting the right structure is crucial for your success in Dubai's dynamic business landscape. Take the time to understand your options and make an informed decision that aligns with your vision!

Registering a business in Dubai by yourself is a straightforward process if you follow the essential steps diligently. First, select the right legal structure for your venture, such as a sole proprietorship, a limited liability company (LLC), or a public limited company (PLC). This choice is crucial as it influences your liability, tax obligations, and overall business management.

Once you've decided on the legal structure, the next step is to draft your articles of association, which detail the operational guidelines for your company. After finalizing these documents, you’ll need to visit a notary for formal notarization. Following that, register your company with the relevant authorities and obtain a VAT number if applicable. This process involves completing necessary forms and providing essential documentation, such as proof of identity and your registered office address. Additionally, you’ll need to open a local bank account in Dubai and deposit your start-up capital to complete the registration process.

While registering a business independently is feasible, our entity management services can help you navigate any complexities that may arise. Whether you require guidance on legal requirements or assistance with documentation, we’re here to ensure a smooth launch of your business in Dubai!

When choosing the right business structure in Dubai, it's essential to consider the legal and operational ramifications of each available option.

For example, a Limited Liability Company (LLC) provides limited liability protection to its shareholders, ensuring that personal assets remain shielded from business debts. In contrast, a sole proprietorship subjects the owner to unlimited personal liability, risking personal assets if the business faces financial challenges.

Taxation is another crucial element that varies among structures. An LLC may present more advantageous tax treatment compared to a partnership, allowing for potential tax benefits that can boost overall profitability. Additionally, employment regulations differ in complexity; corporations often encounter stricter regulatory and reporting requirements, while sole proprietorships generally benefit from simpler compliance obligations.

Moreover, protecting intellectual property is a vital consideration. The business structure can significantly impact a company’s ability to safeguard its innovations and brand assets effectively. Corporations typically provide a more robust framework for protecting intellectual property compared to simpler structures like sole proprietorships, making this a key factor in your decision-making process.

Ultimately, selecting the right structure in Dubai requires careful consideration of liability, taxation, compliance, and intellectual property protection to ensure a strong foundation for your business success.

Establishing a company in Dubai as a non-resident can be a compelling opportunity, thanks to its strategic location and business-friendly environment. However, several essential factors should be considered during this process.

Firstly, it's crucial to grasp the legal requirements for non-residents. You don’t have to be a citizen or resident to set up a business in Dubai, but appointing a local representative is necessary. This representative will handle administrative tasks and liaise with authorities on your behalf.

Moreover, this representative must have a registered office address in Dubai, which is mandatory for company registration. Non-residents should also familiarize themselves with local taxation laws, as they may differ considerably from those in their home countries. Embracing these requirements can pave the way for a successful venture in this vibrant market.

Establishing a company in Dubai as a non-resident can be an enticing opportunity due to its strategic location and favorable business landscape. However, there are several crucial aspects to consider throughout the process.

First, it's vital to grasp the legal requirements for non-residents. While you aren't required to be a UAE citizen or resident to set up a business, appointing a local representative is essential. This individual will manage administrative duties and serve as the primary liaison with UAE authorities on your behalf.

This representative must have a registered office address in Dubai, which is a prerequisite for company registration. Additionally, non-residents should familiarize themselves with UAE taxation laws, as they may vary considerably from those in their home countries. Embracing these guidelines can pave the way for a successful venture in this thriving market.

Establishing a business in Dubai through branch registration requires a clear understanding of the difference between a branch and a subsidiary. A branch registration allows a foreign company to create a physical presence in Dubai without the need to form a separate legal entity. This means the foreign company retains full responsibility for the activities conducted by the branch, including all legal and financial obligations that may arise.

Conversely, setting up a subsidiary involves creating a new legal entity in Dubai that operates independently from the foreign parent company, bearing its own legal and financial responsibilities. When contemplating branch registration, it’s crucial to evaluate how this choice impacts the foreign company’s operations, liabilities, and overall strategy. A branch may be more advantageous for companies looking to maintain direct control over their Dubai operations, aligning closely with the parent company’s objectives, policies, and strategies.

Before moving forward with branch registration, consulting with experts can help navigate the legal and administrative requirements, ensuring a seamless setup process for your business in Dubai.

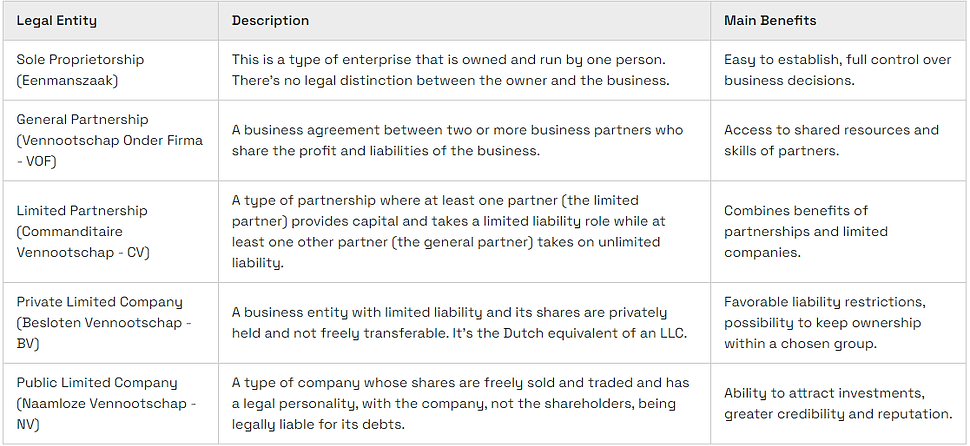

When considering company formation in Dubai, entrepreneurs have a variety of legal entities to choose from, each tailored to different business needs and aspirations.

One of the most popular options is the Limited Liability Company (LLC). This structure offers limited liability to its owners, meaning they are not personally responsible for the company's debts. The LLC is particularly appealing for small to medium-sized enterprises, allowing for flexible management and fewer statutory obligations.

Another option is the Public Joint Stock Company (PJSC), which is typically suited for larger businesses. The PJSC can issue publicly traded shares, making it an ideal choice for companies looking to raise capital through public offerings. This structure also provides limited liability, protecting shareholders from personal liability for the company's debts.

For those interested in a more collaborative approach, the Cooperative Society might be the right fit. This entity enables a group of individuals to come together for a common economic purpose, with members sharing both profits and responsibilities.

If simplicity is preferred, a Sole Proprietorship is the easiest structure to establish. While it allows for complete control over the business, it does not provide limited liability protection, meaning the owner is personally liable for any debts incurred.

Additionally, Dubai offers Partnerships, where two or more individuals share the responsibilities and profits of the business. While this structure allows for flexibility, partners can be personally liable for the partnership's debts.

Each legal entity type presents unique advantages and disadvantages, making it crucial for entrepreneurs to assess their specific needs and long-term goals before making a decision. Consulting with legal and financial professionals can provide invaluable guidance in navigating Dubai's regulatory landscape and ensuring compliance with tax laws. The Corporate Plan offered by Entity Management Services in Dubai is an excellent resource for obtaining tailored advice. For a fixed fee, you can receive a customized and interactive report that covers all your business requirements, including updates and a compliance calendar for the year.

Regardless of the legal entity chosen, all businesses must register with the relevant authorities to ensure compliance with local regulations and to operate legally within the region.

Sign up by completing the form below.

When considering expansion into Dubai, selecting the right legal business structure is a crucial step for global entrepreneurs. The Dubai market, known for its strategic location in the Middle East and its pro-business environment, offers various avenues for foreign companies to establish their presence. Among these options, registering a branch can be particularly appealing for international firms eager to tap into Dubai's dynamic economy.

A branch registration in Dubai allows foreign companies to engage in local business activities while retaining the parent company’s identity and control. This approach provides a straightforward method to explore the market without the complexities associated with creating a separate legal entity. For many entrepreneurs, this flexibility is invaluable, as it enables them to assess market conditions and test their offerings without committing to a full-scale investment.

Furthermore, in certain cases, foreign companies can operate without the need to form a local entity. Activities such as obtaining a VAT number or hiring employees can often be managed without registering a branch, adding another layer of convenience for businesses looking to enter the Dubai market. This adaptability makes Dubai an attractive destination for global entrepreneurs eager to expand their operations and connect with new customers.

Incorporating your company in Dubai is a seamless journey, and I’m here to help you every step of the way! With all your essential documents in order—such as the articles of association and identification—you can expect to complete the registration process in just a few days.

Start by preparing your documents, which usually takes about 1-2 days. Once ready, you'll need to have them notarized, typically requiring only one additional day. After notarization, you can register your company with the relevant authorities, often achieving this on the same day. If your business needs a VAT number, this step may take an extra 1-2 weeks, depending on the processing times from the Tax Office.

It’s also crucial to connect with the local Chamber of Commerce to ensure you meet any specific industry requirements or regulations. We're here to provide valuable insights and support as you navigate the incorporation process, making your entrepreneurial dreams a reality in Dubai!

To register a company in Dubai, you need to prepare the following essential documents:

Notarized Articles of Association: This document outlines your company's structure and operational rules.

Proof of Identity: Valid identification is required for each director and shareholder involved in the LLC.

Deed of Incorporation: This document must be notarized and is crucial for the registration process.

Once you have these documents ready, the next step is to submit them to the relevant authorities and pay the registration fee. Upon successful registration, you will receive a unique enterprise number, essential for conducting business in Dubai.

For non-residents, appointing a local representative or utilizing a registered agent is necessary to streamline the registration process. Additionally, depending on the nature of your business, you may need to acquire specific licenses or permits.

Familiarizing yourself with these requirements is vital for ensuring a smooth and efficient company registration experience in Dubai.

When drafting the Articles of Association for a company in Dubai, it’s essential to incorporate key elements that establish the company's foundation. These elements typically include the company name, registered office address, purpose of the business, and the rights and obligations of the members. Furthermore, it’s important to outline the distribution of shares, governance structures, and decision-making processes within the company.

Having these components clearly defined fosters transparency and facilitates smooth internal operations. This legal document is crucial for delineating how the LLC will operate within the regulatory framework of Dubai.

To ensure precision and compliance with legal standards, seeking advice from legal experts is highly advisable. They can customize the Articles of Association to align with the company’s specific structure and objectives, ensuring that all necessary details, such as member rights and the decision-making hierarchy, are thoroughly addressed.

Appointing directors and shareholders in Dubai is a streamlined process that plays a crucial role in a company's governance. An LLC in Dubai requires at least one director, who can also serve as a shareholder, allowing for efficient management, especially beneficial for smaller enterprises.

The selection of directors and shareholders greatly impacts the company's operations and strategic direction. It's important to choose individuals with the appropriate qualifications and experience, as they will be tasked with making critical decisions and representing the LLC in official matters. Shareholders contribute capital and hold significant influence in governance, participating in votes on major business issues and benefiting from dividends.

When selecting directors and shareholders in Dubai, prioritize their expertise, reputation, and alignment with the company’s vision. A solid understanding of local corporate laws and regulations is essential to ensure compliance and minimize legal risks, paving the way for sustainable success in the dynamic Dubai market.

Opening a business bank account in Dubai involves meeting specific legal and documentation requirements. First, your company must be registered with the relevant authority, and you need to have a valid business address in the UAE. Essential documents for the bank account application typically include the Articles of Association, proof of registration with the local tax authorities, and identification documents for the directors.

For non-residents seeking to establish a business bank account in Dubai, additional regulations come into play. This may involve providing proof of residency and documentation to demonstrate legal representation, such as a local agent or representative. These measures are designed to ensure compliance with UAE banking regulations and anti-money laundering laws, thereby safeguarding the integrity of the financial system.

By navigating these requirements efficiently, entrepreneurs can seamlessly access banking services that support their business growth in this dynamic market.

Here’s a comprehensive step-by-step guide to launching your business in Dubai, specifically focusing on the popular Dubai LLC (Limited Liability Company):

Determine the ideal legal structure for your company in Dubai, considering options like an LLC (Limited Liability Company), public limited company, or sole proprietorship. Assess key factors such as liability exposure, tax implications, and management framework to select the best fit for your business objectives. Make an informed choice that aligns with your vision and paves the way for success in the dynamic Dubai market.

When establishing your company in Dubai, crafting the Articles of Association is crucial. This document should clearly outline essential elements such as the company’s name, its primary purpose, share distribution, and governance structure. By articulating these key aspects, you lay the groundwork for effective management and operation.

You can get your Articles of Association properly notarized by going to a notary.Bring any identification papers you need and any drafts of the articles you have already written.

Submit your notarized Articles of Association and finalize the registration process with the CBE. Upon completion, you'll receive a unique enterprise number, crucial for your business operations in Dubai. This number serves as your official identification within the local business landscape, ensuring smooth compliance and streamlined operations as you embark on your entrepreneurial journey.

If your business needs one, you can get a VAT number from the Dubai tax officials. Give the required information, such as proof that you are registered with the CBE.

Use your company's firm number and the Articles of Association to open a business bank account in Dubai. You will need to show proof of your listed business address and identification for each director.

To establish an effective accounting system for managing financial records and ensuring compliance with Dubai's tax laws, it's advisable to engage an accountant or financial advisor well-versed in local regulations.

This process serves as a general guideline, recognizing that individual circumstances may vary and might require additional steps, such as obtaining specific licenses or permits tailored to the industry or business type. Implementing a robust financial framework not only facilitates accurate reporting but also strengthens your business's foundation in the vibrant Dubai market.

When launching a business in Dubai, registration costs depend on the type of business entity you select. For a sole proprietorship, the registration fee can be quite low, while a limited liability company (LLC) will incur higher expenses, including notary fees and registration with the Dubai Business Register.

You should also anticipate additional costs for legal assistance, drafting your articles of association, and obtaining any necessary licenses. It’s crucial to account for ongoing expenses, such as accounting and tax management, as these can significantly impact your overall startup investment. Embrace the opportunity to build a thriving business in Dubai while keeping your financial planning in check!

To operate legally in Dubai, businesses are required to register with the Dubai Business Register and the local tax authorities. This process includes completing necessary forms, submitting identification documents, and providing evidence of a business address. Ensuring compliance from the outset lays a solid foundation for success in the dynamic Dubai market.

The Business Central Entity (BCE) acts as the central database for all businesses in Dubai. To get started with your registration, you must complete an application form and submit your business plan, identification, and proof of address. Once your application is successfully processed, you will receive a unique enterprise number. This number is crucial for legal recognition and essential for conducting business transactions within the dynamic Dubai market. Launch your entrepreneurial journey in Dubai and unlock new opportunities!

After registering with the local Business Registration Authority, businesses in Dubai must also connect with the tax authorities to secure a VAT number and meet their tax obligations. This essential step enables companies to collect VAT and ensures compliance with corporate tax requirements, paving the way for smooth operations and financial success in the thriving Dubai market.

As a registered business in Dubai, it's essential to keep your information updated with the Dubai Business Registration Authority. Reporting any changes in your business activities, management, address, or legal structure ensures compliance with local regulations. Here’s how to effectively navigate these responsibilities:

Business Activities: If your company expands or alters its operations, promptly update the Business Registration Authority to reflect these new activities. This ensures accurate classification and compliance with relevant laws.

Management Changes: Notify the Authority of any changes in your management team or ownership structure. This includes appointing new directors or modifying shareholding arrangements to maintain transparency.

Address Changes: If your business relocates to a new address, it's crucial to inform the Authority. Keeping accurate records is essential for official correspondence and legal compliance.

Legal Structure Adjustments: If you decide to change your business's legal structure—such as converting from a sole proprietorship to a Limited Liability Company (LLC)—report this to the Authority. Updating your enterprise registration helps meet legal obligations.

Updating Documents: Along with notifying the Authority, ensure that all relevant documents, such as articles of incorporation and shareholder agreements, reflect the changes made. This fosters transparency and upholds legal integrity.

Remember, while updating your company information may seem like routine housekeeping, it's a vital step in maintaining your business's legal and financial health in Dubai. Keep your operations smooth and compliant for continued success!

Understanding the taxation landscape in Dubai is essential for individuals and businesses alike. The tax system here encompasses various levies, including corporate tax, value-added tax (VAT), withholding tax, and municipal taxes.

Dubai offers a competitive environment for businesses, particularly with its attractive corporate tax incentives. The corporate tax rate has been significantly reduced, making it more appealing for both local startups and multinational corporations. Additionally, specific deductions and exemptions encourage investment and innovation, enhancing the overall business climate.

For companies operating in Dubai, compliance with tax regulations is crucial. Organizations must prepare annual financial statements in accordance with local accounting standards, ensuring accuracy and transparency. Depending on certain criteria, these statements may also require an audit, reinforcing the importance of meticulous financial management.

Staying on top of tax obligations not only fosters a smooth operational flow but also positions your business for long-term success in the Dubai market. Embrace the opportunities that Dubai’s taxation framework offers, and ensure your LLC is well-equipped to thrive in this dynamic environment.

The tax framework in Dubai presents several advantages for businesses, including:

R&D Tax Incentives: Companies involved in research and development can enjoy substantial tax credits, encouraging innovation and technological advancement.

Double Taxation Treaties: Dubai boasts a wide range of treaties to mitigate double taxation, enabling international businesses to lower their overall tax burden effectively.

Investment Allowances: Specific tax benefits are available for investments in key sectors like technology and sustainability, fostering growth and development in these crucial areas.

These features make Dubai an attractive destination for business growth and investment.

In Dubai, companies face Corporate Income Tax (CIT) on their global earnings. The standard rate stands at 25%, while a reduced rate of 20% applies to small LLCs on the initial €100,000 of profit. Businesses can enhance their tax efficiency by utilizing various allowable deductions to lower their taxable income, creating a strategic approach to managing their financial responsibilities.

In Dubai, VAT is set at a standard rate of 5%, with reduced rates of 0% and various exemptions applicable to specific goods and services. Businesses are required to collect VAT on their sales, allowing them to reclaim VAT on business-related purchases. This mechanism is vital for optimizing cash flow and enhancing financial management. Understanding and leveraging VAT regulations effectively can provide a significant advantage for companies operating in the dynamic Dubai market.

Dubai imposes a 30% withholding tax on dividends distributed to shareholders; however, this rate can be reduced or eliminated based on specific tax treaties or if the recipient qualifies as a parent company. The participation exemption further enhances the investment landscape by allowing for tax-free dividends under certain conditions, thereby encouraging corporate investments and fostering a robust economic environment. This framework positions Dubai as an attractive destination for businesses seeking to optimize their dividend tax liabilities.

In Dubai, employers are required to withhold payroll taxes from their employees' salaries, encompassing personal income tax and social security contributions. The social security framework in Dubai is robust, offering extensive coverage that includes healthcare, pensions, and unemployment benefits. This system ensures security for both employees and employers, fostering a stable work environment that supports workforce well-being and productivity. By adhering to these regulations, businesses not only comply with local laws but also contribute to a sustainable economic ecosystem that benefits all parties involved.

Businesses in Dubai may encounter various local taxes, environmental fees, and specific levies tied to their industry. Effective tax planning and adherence to regulations are crucial for steering clear of penalties and ensuring seamless operations. With the right strategies in place, companies can navigate the tax landscape in Dubai confidently, optimizing their financial performance while maintaining compliance.

Dubai offers a range of tax incentives aimed at fostering entrepreneurial growth and encouraging investment. Here are some key incentives available to businesses:

This incentive allows companies to benefit from a reduced corporate tax rate on income derived from innovative activities, such as patents and R&D. Under this regime, businesses can deduct a percentage of their qualifying income from the taxable base, resulting in a significantly lower effective tax rate.

Small and medium-sized enterprises (SMEs) in Dubai can take advantage of reduced corporate tax rates on the first portion of their taxable income. This measure is designed to support the growth of smaller businesses and encourage their contribution to the economy.

Dubai provides an investment deduction for businesses that invest in certain qualifying assets. This deduction allows companies to deduct a percentage of the investment from their taxable income, promoting capital investments and helping businesses grow.

Dubai offers exemptions on withholding tax for certain dividends paid to qualifying shareholders. This incentive is particularly beneficial for multinational companies looking to streamline their international investments and repatriate profits tax-efficiently.

To stimulate research and development, Dubai companies can benefit from tax credits for eligible R&D expenses. These credits can substantially reduce the overall tax burden for companies investing in innovative projects and technologies.

Dubai encourages environmentally friendly investments through various tax incentives, including reduced rates and deductions for investments in renewable energy and energy-efficient technologies. This support aligns with the EU’s sustainability goals and promotes a greener economy.

All established companies in Dubai must adhere to the following key financial obligations:

Maintain Accurate Financial Records: It’s crucial for businesses to keep detailed records of their operations to ensure compliance with tax regulations.

Prepare Annual Financial Statements: Companies are required to produce a comprehensive set of financial statements, including a balance sheet, income statement, and cash flow statement, accurately reflecting their financial status.

File with the Relevant Authorities: Financial statements must be submitted to the appropriate regulatory body within designated timelines to fulfill legal obligations.

Compliance with Accounting Standards: Firms must adhere to Dubai’s Generally Accepted Accounting Principles (GAAP) or, for publicly listed entities, International Financial Reporting Standards (IFRS).

Auditing Requirements Small LLCs: Generally exempt from mandatory audits, alleviating administrative burdens and promoting efficiency.

Medium and Large LLCs: These companies are required to undergo annual audits conducted by registered external auditors to ensure the integrity and reliability of their financial reports.

Foreign LLCs operating in Dubai are subject to the same financial reporting and auditing standards as local businesses. Understanding these obligations is vital, as non-compliance can lead to legal repercussions. Ensure your business stays informed and meets all necessary requirements to thrive in Dubai's dynamic market!

Small Companies: Generally exempt from mandatory audits, small companies benefit from reduced administrative burdens, allowing them to focus on growth and operations.

Medium and Large Companies: Medium and large LLCs are required to undergo annual audits conducted by registered external auditors. This process ensures financial reliability and builds trust with stakeholders.

Foreign Companies: Foreign LLCs in Dubai must adhere to the same financial reporting and audit requirements as local entities. Non-compliance can lead to significant legal penalties, making it crucial for businesses to fully understand these obligations to maintain compliance and avoid pitfalls.

Hiring personnel in Dubai can be an efficient and rewarding process, thanks to the region's highly educated workforce and supportive recruitment environment. The local labor market is characterized by its diversity and multilingual capabilities, making it an attractive option for businesses seeking to expand.

Skilled Workforce: Dubai boasts a talented and multilingual labor pool. With a strong emphasis on education and training, many professionals in the area are fluent in several languages, including Arabic and English. This linguistic diversity enhances communication in multicultural work settings and benefits international companies operating in the region.

Professional Recruitment Agencies: Dubai is home to a variety of specialized recruitment agencies that cater to different sectors. These agencies have in-depth knowledge of the local job market and can assist businesses in finding qualified candidates that meet their specific needs. Their expertise streamlines the recruitment process, making it easier for new ventures to secure the right talent.

Flexible Labor Market: The labor market in Dubai offers a range of employment contracts, including full-time, part-time, and temporary positions. This flexibility enables businesses to adapt their workforce based on project requirements or seasonal fluctuations, enhancing operational efficiency.

Digital Hiring Platforms: In Dubai, digital job portals and professional networking sites are widely utilized for recruitment. Posting job vacancies online allows companies to reach a broad audience, attracting both local talent and expatriates. This strategy is particularly beneficial for startups aiming to establish a strong market presence.

Labor Laws and Regulations: Businesses must understand Dubai's labor laws, which include regulations on non-discrimination, data privacy, and fair employment practices. Compliance with these laws is essential to avoid potential legal challenges. Consulting with local legal experts or HR professionals can help navigate the complexities of employment regulations in the region.

Wage Structure and Employee Rights: Dubai has a regulated minimum wage system and robust worker protection laws, ensuring fair compensation and rights for employees. Employers are also responsible for providing social security benefits, including health care and pension contributions. This commitment to employee rights fosters a stable labor environment, although it may lead to higher labor costs for businesses.

While some employers may find the regulatory framework and associated costs challenging, these measures reflect Dubai's dedication to maintaining a fair and equitable labor market.

For entrepreneurs considering the Dubai market, a comprehensive understanding of labor laws, workforce planning, and budget management is crucial for building a sustainable and successful LLC.

In summary, the combination of a skilled workforce and a supportive recruitment framework makes Dubai an excellent choice for companies looking to hire and grow.

Protecting intellectual property in Dubai is crucial for businesses seeking to secure their innovations and maintain a competitive advantage. Safeguarding intellectual assets involves registering patents, trademarks, and copyrights with the relevant authorities. This formal registration not only establishes legal ownership but also deters unauthorized use or reproduction by competitors.

The registration process requires submitting comprehensive applications that undergo a thorough examination. Once approved, companies enjoy exclusive rights to their intellectual creations, which is vital for nurturing innovation and ensuring fair market practices.

To uphold these rights, businesses must stay vigilant against potential infringements. This involves monitoring the market for unauthorized use of their intellectual property and taking appropriate legal actions when necessary. Strategies may include issuing cease and desist letters, engaging in mediation, or pursuing litigation to resolve disputes. By proactively protecting their intellectual property, companies can defend their unique offerings in the dynamic Dubai market.

Acquiring the necessary permits and licenses is essential for businesses to operate legally and effectively in Dubai. Different sectors require specific authorizations, making it crucial for companies to navigate the regulatory landscape pertinent to their industry.

Most enterprises need a general business license to kickstart their operations. However, certain industries—such as healthcare, food services, and construction—face additional requirements. These might include safety inspections, environmental assessments, or industry-specific certifications.

Conducting comprehensive research to ensure compliance with all relevant regulations and permit requirements is vital. Engaging with legal advisors or industry professionals can offer valuable insights and support throughout the process.

Maintaining accurate records of all permits and licenses is critical, as this demonstrates compliance during inspections or audits. By proactively managing their regulatory obligations, businesses can sidestep potential fines, penalties, or disruptions in their operations within Dubai.

By emphasizing intellectual property protection and ensuring all necessary permits and licenses are secured, companies can confidently navigate the business landscape of Dubai, focusing on growth and innovation.

Starting a business in Dubai involves a series of essential steps. First, you must select the legal structure that best fits your business, such as an LLC (Limited Liability Company) or a Free Zone entity. After choosing your structure, you’ll need to register with the Dubai Department of Economic Development (DED) or the relevant Free Zone authority, obtain a trade license, and secure any necessary permits. Opening a local bank account is also crucial for managing your business finances and ensuring compliance with VAT regulations, if applicable.

Yes, depending on your business type, specific permits may be required. While general business registration is mandatory for most ventures, industries such as hospitality, healthcare, and construction may need additional licenses or approvals. It's vital to research the requirements specific to your sector and location to ensure compliance.

Dubai offers various legal structures for businesses, including:

LLC (Limited Liability Company) – Suitable for small to medium-sized enterprises, providing liability protection to owners.

Free Zone Company – Ideal for businesses focusing on export or import, with benefits like full foreign ownership and tax exemptions.

Sole Proprietorship – A simple structure for individual entrepreneurs, where the owner has full control but unlimited liability.

Dubai boasts an attractive tax regime for businesses. Companies generally benefit from zero corporate tax rates in many free zones, although certain activities may incur a 9% corporate tax. Businesses must also comply with VAT regulations, which is set at a standard rate of 5%. Depending on your business activities, additional taxes such as municipality fees or environmental levies may apply. Consulting a tax advisor can help you optimize your tax planning and ensure compliance.

Dubai's diverse and highly skilled workforce makes it a prime location for talent acquisition. You can hire employees through various channels, including recruitment agencies, online job platforms, and networking events. Be aware of Dubai's labor laws, which cover employment contracts, minimum wages, working hours, and social security contributions. Many businesses also offer competitive employee benefits, such as health insurance and retirement plans, to attract top talent.

Yes, Dubai offers numerous incentives for foreign businesses and investors. These include tax benefits, such as exemptions in specific free zones, and initiatives aimed at promoting research and development (R&D). Additionally, Dubai's strategic location and access to key markets in the Middle East make it a compelling choice for international businesses.

Yes, establishing a Dubai bank account in your company’s name is mandatory for all businesses. This account is essential for managing financial transactions, including paying taxes, employee salaries, and operational expenses. Having a local bank account also streamlines VAT payments and other financial obligations to local authorities.

The registration timeline for a business in Dubai can vary from a few days to several weeks, depending on the complexity of your business and the chosen legal structure. A straightforward registration process, such as for an LLC or Free Zone company, can often be completed within 1-2 weeks if all documentation is in order. Additional permits or licenses may extend this timeline.

Dubai provides robust intellectual property protections for businesses through both national and international frameworks. You can register patents, trademarks, and copyrights with the UAE Ministry of Economy. These registrations grant you legal protection against unauthorized use or infringement, helping to safeguard your innovations, products, and branding.

The cost of starting a business in Dubai varies based on factors like legal structure, industry, and specific licensing requirements. For example, establishing an LLC may necessitate an initial capital investment of around AED 300,000, while a Free Zone company often has lower capital requirements. Additionally, consider administrative fees for registration, legal consultations, and ongoing operational costs, including taxes, salaries, and permits. Careful planning and budgeting are essential to navigate these expenses effectively.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!